Management Discussion and Analysis

The IMF World Economic Outlook (January 2025) has estimated India’s real GDP growth in 2024-25 (FY2025) at 6.5%. This is significantly higher than all major countries in the world, including China. Moreover, it has projected the same growth rate – 6.5% for FY2026. This is very much in line with the estimates released by the National Statistical Office (NSO) of the Government of India.

India has also seen continuing moderation of price inflation. Wholesale Price Index inflation has remained well under 4%. Inflation based on the Consumer Price Index for Industrial Workers (CPI-IW) has stayed between 2% and 4%. And inflation based on the Consumer Price Index for Agricultural Labourers (CPI-AL) has steadily fallen a bit over 4% in February 2025. With no imminent fear of inflation, the RBI’s Monetary Policy Committee, in its first meeting of FY2026, unanimously decided to reduce the repo rate by 25 basis points to 6 per cent.

India’s current account deficit (CAD) for Q3 of FY2025 (October-December 2024) stood at 1.1% of GDP. For an economy growing 6.5% real with no near-term inflation risks, this is not a CAD that one should worry about.

The Union Budget 2025 raised the income threshold for full tax rebates from ₹ 7 lakh to ₹ 12 lakh, effectively increasing disposable income for a broader segment of middle-income earners. This development is expected to bolster consumer sentiment and support discretionary spending. Given that this income group represents a significant share of two-wheeler and three-wheeler buyers, the measure is likely to have a positive impact on demand in the personal mobility segment.

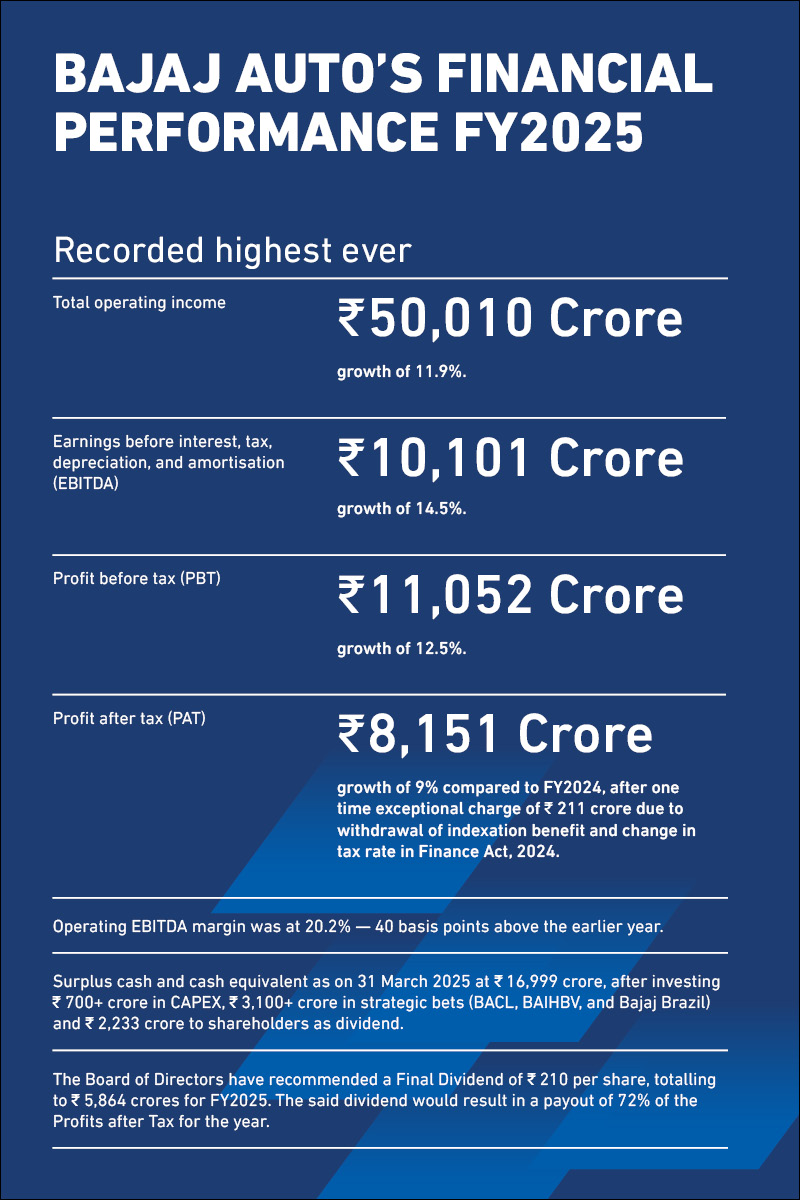

Amidst this good macroeconomic scenario, Bajaj Auto has performed better than ever before. Here is a snapshot.

Domestic Motorcycles

The domestic motorcycles industry recorded modest growth of 5% in FY25 totalling of 12.25 million units. Compared to this, performance of Bajaj Auto is reflected in Table 1 below

We remain focussed on growing the strategically important 125cc+ segment, with brands like Pulsar, Dominar, KTM, Husqvarna & Triumph. Our latest launch of Freedom brand, world’s first CNG bike is an attempt to upgrade the 100-110cc riders with an offering, which provides ~50% savings in operating costs, while also setting the new benchmarks of styling and comfort.

We have noticed some pressure on the market share towards the second half of the year, and accordingly we have taken suitable product and pricing interventions to recoup the lost market share and continue to further expand the 125cc+ segment.

|

Table 1: Domestic Sale of Motorcycles (in numbers) |

||||||||||

|

Year ended 31 March |

Market (nos.) |

Market growth |

BAL (nos.) |

BAL’s growth |

BAL’s market share |

|||||

|

2022 |

8,984,186 |

(10.3%) |

1,632,897 |

(9.7%) |

18.2% |

|||||

|

2023 |

10,230,502 |

13.9% |

1,769,575 |

8.4% |

17.3% |

|||||

|

2024 |

11,653,237 |

13.9% |

2,121,491 |

19.9% |

18.2% |

|||||

|

2025 |

12,252,305 |

5.1% |

2,031,066 |

(4.3%) |

16.6% |

|||||

Key Highlights

●Domestic motorcycle revenue hit a peak on the focussed 125cc+ segment.

●Pulsar continues to lead the way, crossing ₹ 10k crores in domestic revenue (~₹ 15k crores globally), on the back of the highest-ever retails in 125cc+ segment reinforcing the strength of its proposition.

●Freedom, World’s first CNG Bike, turned >₹ 500 crores brand within 5 months of its launch.

●KTM – Triumph duo sells ~1 lakh units domestically, reflecting the strength of an expanded portfolio at the premium end.

●KTM accelerates momentum post the refresh of the Duke 200/250 and introduction of an all-new Adventure range. The India portfolio was expanded with 10 internationally acclaimed high-performance bikes (up to 1390cc) during the year, catering to different segments (Dirt, Enduro, Adventure and Street) to delight Indian sports motorcycling enthusiasts.

●Triumph sales were up >60% YoY aided by wider access as network expanded to 136 premium showrooms across 100 cities, each built to Triumph’s global standards and format, and new products (Speed T4, MY25 Speed) were well received.

Domestic Three-Wheelers

ICE industry recorded a decline of 4% this year vis a vis a 7% decline for Bajaj Auto. However, this loss in volumes was partially recouped by the growth in EV portfolio which grew 376% vs. 59% increase for the industry. This strong performance in the EV space underscores the company’s strategic pivot and resilience in a rapidly evolving mobility landscape.

The quantitative performance in this segment is highlighted in Table 2.

|

Table 2: Domestic Sale of Three-Wheelers (in numbers) |

||||||||||||

|

Particulars |

ICE three-wheelers |

EV three-wheelers |

||||||||||

|

FY2025 |

FY2024 |

FY2023 |

FY2025 |

FY2024 |

FY2023 |

|||||||

|

Passenger sales |

|

|

|

|

|

|

||||||

|

Industry sales |

455,879 |

483,955 |

329,784 |

134,810 |

69,887 |

15,628 |

||||||

|

Bajaj Auto sales |

368,638 |

400,846 |

261,386 |

52,517 |

10,761 |

0 |

||||||

|

Bajaj Auto market share |

80.9% |

82.8% |

79.3% |

39.0% |

15.4% |

0.0% |

||||||

|

Goods carriers |

|

|

|

|

|

|

||||||

|

Industry sales |

100,071 |

95,276 |

81,309 |

27,593 |

32,044 |

17,018 |

||||||

|

Bajaj Auto sales |

52,481 |

50,336 |

38,623 |

5,680 |

1,470 |

0 |

||||||

|

Bajaj Auto market share |

52.4% |

52.8% |

47.5% |

20.6% |

4.6% |

0.0% |

||||||

|

Total three-wheelers |

|

|

|

|

|

|

||||||

|

Industry sales |

555,950 |

579,231 |

411,093 |

162,403 |

101,931 |

32,646 |

||||||

|

Bajaj Auto sales |

421,119 |

451,182 |

300,009 |

58,197 |

12,231 |

0 |

||||||

|

Bajaj Auto market share |

75.7% |

77.9% |

73.0% |

35.8% |

12.0% |

0.0% |

||||||

Key Highlights

●Commercial Vehicles deliver record volumes; revenues breach ₹ 10K crores mark for the first time.

●ICE vehicles continued to remain undisputed leader in the segment with 75% of market share.

●Electric three-wheeler volumes were up 4x YoY and market share trebled during the year.

●The launch of ‘GoGo’ brand with features loaded products and a network of 850+ dealerships is poised to drive the next wave of growth and decisive segment leadership.

Electric Two-Wheeler

The electric two-wheeler industry has grown 20%+ during this year and has been the fastest growing segment in the industry. Bajaj Auto has been the front runner in this growth led by a focussed innovation, strong product proposition, and rapid network expansion. Table 3 gives the data on domestic sales.

|

Table 3: Domestic Sale of Chetak EV (in numbers) |

||||

|

Year ended 31 March |

Domestic Sale (nos.) |

Growth |

||

|

2022 |

8,187 |

487% |

||

|

2023 |

36,260 |

343% |

||

|

2024 |

115,702 |

219% |

||

|

2025 |

260,033 |

125% |

||

Key Highlights

●Chetak firmly exits the year as #1 electric scooter, as volumes more than double and market share grows +900 bps YoY.

●The new Chetak 35 series launched in December, received a strong response for its best-in-class range, enhanced storage and faster charging, along with the launch of the affordable variant earlier this year.

●Rapid expansion of network to >4,000 touchpoints propelled the business to leadership.

International Business

Exports hit their peak volume in FY22, post covid, when the world was flushed with liquidity. However, the subsequent years—FY23 and FY24—posed significant challenges due to turbulent macro-economic conditions, including sharp local currency fluctuations and Fx unavailability in key international markets. These headwinds led to a notable decline in export volumes. As economic conditions begin to stabilize, FY25 signals a turning point, suggesting that the worst of the downturn is behind us. Early signs of a strong recovery are evident, with total export volumes rising to 1.86 million units in FY25, up from 1.64 million in FY24. This recovery is visible across both motorcycles and commercial vehicles, reaffirming Bajaj Auto’s resilience and adaptability in the face of external disruptions. Table 4 presents a yearly breakdown of this performance.

In FY2025:

●Exports rebounded strongly to double digit volume and revenue growth

●Exports constitute 33.7% of our sales in FY25, versus 33.2% last year.

●Bajaj Auto sold over 1.86 million units — a growth of 13.9%.

●Both motorcycles and commercial vehicles recorded a double-digit growth.

●The LATAM region recorded the highest ever motorcycle sales.

|

Table 4: Export Volume and Value for Bajaj Auto |

||||||||

|

FY2025 |

FY2024 |

FY2023 |

FY2022 |

|||||

|

Units |

|

|

|

|

||||

|

Motorcycles |

1,674,060 |

1,477,338 |

1,636,956 |

2,195,772 |

||||

|

Commercial Vehicles |

189,221 |

158,872 |

184,284 |

310,854 |

||||

|

Total numbers |

1,863,281 |

1,636,210 |

1,821,240 |

2,506,626 |

||||

|

Exports in ₹ (crore) |

16,254 |

14,449 |

14,458 |

16,934 |

||||

|

Exports in USD (million) |

1,875 |

1,705 |

1,787 |

2,172 |

||||

Motorcycle exports:

●Bajaj Auto maintained No.1 position in the top eight out of 12 key countries that it exports to.

●ASIA and Latin America registered significant growth: 51% in the former and 30% in the latter.

●Pulsars (up 27% YoY) and Dominar (up 24% YoY) registered new peaks.

●CT have grown impressively, with volumes up 57% YoY.

●Triumph Speed400 and Scrambler400X motorcycles are being exported across 17 countries.

Commercial vehicles exports:

●Leadership position was maintained in 11 out of 12 key countries that it exports to.

●Asia and West Africa registered significant growth: 50% in the former and 58% in the latter.

●Philippines, Bangladesh, Cambodia, Nigeria and Guatemala have shown growth in both volumes and market share.

Outlook

We remain committed to strengthening our presence and delivering excellence across all segments we operate in. Our priorities for the coming year are multi-faceted. A key focus will be on restoring competitiveness in the strategically important 125cc+ motorcycle segment. We aim to unlock the full potential of the GoGo brand in the electric three-wheeler space, mirroring our leadership in the ICE category. The new Chetak range will be executed with the intent to significantly step up volumes and market share. We expect the export recovery to sustain, supported by improving macro-economic conditions. Multiple product launches across the KTM and Triumph portfolios are planned to further strengthen our global market positioning. Throughout this journey, we remain mindful of margin pressures arising from an increasingly competitive landscape and a strengthening rupee, and will navigate these challenges with disciplined execution.

Risks & Opportunities

In any business, risks and opportunities are two sides of the same coin and mastering both is essential to sustainable success. We recognize that the external environment is dynamic—whether it’s geopolitical shifts, regulatory changes, technological disruption, or supply-chain vulnerabilities—such evolving risks must be continuously scanned and anticipated. Guided by our robust Enterprise Risk Management (ERM) framework, we systematically identify, assess, monitor, and govern these risks across the organization. Equally, we strive to convert uncertainties into strategic advantage—by developing response plans that not only mitigate threats but also position us to capture high-value opportunities through proactive response strategies and integrated business decision-making. This dual-focus approach ensures we are both resilient and agile—prepared to protect our business and nimble enough to seize tomorrow’s growth possibilities.

Internal Control system and their adequacy

Our company has established a comprehensive internal financial control (IFC) framework to ensure the integrity, reliability, and compliance of our financial reporting and operations. In accordance with Section 134(5)(e) of the Indian Companies Act, 2013, and SEBI LODR requirements, management and the audit committee annually assess the design and operating effectiveness of our IFCs, affirming their adequacy in supporting orderly business conduct and safeguarding assets.

Our IFC system encompasses key elements—control environment, risk assessment, control activities, information and communication, and ongoing monitoring—aligned with globally recognised frameworks like COSO and ICAI guidance. We maintain a robust process for documentation, periodical review, and testing of controls through independent team, who report their findings to the management, with timely remediation of any gaps or deficiencies. Based on periodic testing, the IFC framework is updated annually to ensure continuous improvement and to ensure ongoing effectiveness of controls.

Furthermore, statutory auditors evaluate the operating effectiveness of IFCs under Section 143(3)(i) and have consistently reported no material weaknesses or significant deficiencies, underscoring the reliability of our financial disclosures. We acknowledge that while no system can offer absolute certainty, inherent limitations are managed through ongoing enhancements and policy updates to address evolving business risks.

In summary, our internal financial control framework is well designed, diligently monitored, and tailored to our company’s size and complexity—providing reasonable assurance on financial accuracy, fraud prevention, regulatory adherence, and effective oversight by our management.

Research & Development

For our company, Research & Development isn’t just a department – it’s the heart of our strategy and the engine of our excellence. In today’s fast-paced global landscape, especially when underpinned by AI and cutting-edge technologies, boosting R&D is not merely optional – it’s an imperative for growth. Therefore, we place R&D at the centre of every major initiative – fuelling new products, refining processes, and unlocking transformative synergies. This unwavering commitment ensures we don’t just adapt to change; we shape it.

While we had done many great innovations and improvement during the year, some of our breakthrough innovations are as follows:

World’s First CNG Motorcycle : Freedom

The world’s first CNG 2-wheeler, features a unique patented design of vehicle frame and CNG tank to create a safe, structurally strong motorcycle with distinct looks. With an on-road range of 102 km/kg in CNG mode, it not only halves the running cost but also emits 26% lesser CO2 emissions than comparable gasoline motorcycle. The vehicle has been extensively tested under harsh conditions and subjected to multiple crash tests to showcase the safety aspect of the CNG fuel system. It has won several awards for technology and Bike of the year.

New Floorboard Platform for Electric Two-Wheeler : Chetak 35 Series

The Chetak range was upgraded with the Launch of 3501 and 3502 with optimized Powertrain package, Floorboard Battery, best in class boot space of 35 liter and 5” touch TFT (Full map, Document storage). The charging time has been reduced with a 950W charger. The range has a iFuse for safety (Patented) and an Integrated Motor + MCU for cost optimization.

Feature loaded all new Electric Three-Wheeler : GoGo

Electric three-wheelers were rebranded as GoGO and this was launched in January with the GoGo P7012, GoGo P5009, GoGo P5012, GoGo C9012, and GoGo C9009. The range has Best in class Performance, Advance TecPac features, Premium interior and styling and LED lighting. The Maxima Z and the RE are launched with 12 Kw battery packs giving them the best range in this class.

Along with this, the CV Platform of engines are upgraded from 2V to 4V, with ISG and Idle Start Stop (IDSS) along with the OBD2B changeover. The 4V engine delivers better low-end torque, improved transmission and fuel economy and increased durability of the power pack. The idle start stop offers rider comfort for congested traffic while giving better fuel economy.

Platform upgrade to meet OBD2B requirements

The entire ICE platform is upgraded from OBD2A to OBD2B. The On-Board Diagnostics stage 2 extends the standard to CAT monitoring. The catalyst is continuously monitored for optimal performance ensuring durability and emission performance.

Pulsar NS 400

NS line of muscular streetfighters has been upgraded with the NS 400. It features a new styling, new LED projector Head lamp and a Fully Digital reverse Colour LCD Instrument cluster. The electronic throttle control with true ride mode gives the customer unique riding experience basis the actual road conditions. For further safety, the vehicle has traction control. It also uses sintered brake pads for sharp & sporty brake feel.

Pulsar N 125

Launched with an all new supermoto inspired style, fork covers to give the vehicle a muscular look, new 125cc engine with Idle Start stop (IDSS) and best in class performance.

Pulsar RS 200

The vehicle has been upgraded with a unique integrated tail lamp and indicator, LED projector head lamps for improved visibility and ABS ride modes with MTC (Motorcycle Traction Control).

Pulsar NS 160 and NS 200

The models are upgraded with ABS ride modes which allow the user to select ABS interventions basis the road and weather conditions.

Duke & RC 200 UG

The Duke and RC 200 Gen 2 bikes were upgraded with a connected TFT speedometer which allows the rider better visual readout, music and navigation features.

KTM Adventure (390 R/S, 390 X and 250)

KTM Adventure 390 R/S is the flagship Adventure bike and has been upgraded with sports 21- and 17-inch tubeless spoke wheel rims with 230 mm suspension travel for true off-road experience and comes with a fully adjustable suspension, cornering ABS ride modes.

Triumph 400X and Scrambler XC

The 400X is the entry level Triumph with better low-end torque for effortless everyday city riding requiring lower gear shifting. It has been made more affordable with requisite changes to the Vehicle and Engine. The Scrambler XC is an update to the existing scrambler with premium fit and finish updates to the front fender, fairing, engine guard and seats. It also gets tubeless alloy wheels making it the perfect mid-range on-off road bike.

Operations

Bajaj Auto’s ‘back end’ consists of its manufacturing, materials, engineering and development function. The principles and philosophy of TPM guide and align these functions to achieve excellence, enhanced productivity and world-class quality, all at optimized cost. ‘The TPM way’ also covers our vendors, dealers, and international distributors to create and nurture excellence. Bajaj Auto has rigorously established a production system that can flexibly respond to faster new product manufacturing requirement as well as meet volatility, uncertainty, complexity and ambiguity (VUCA) in market demands. To improve operational parameters, our engineering team has developed capabilities using robotics and deploying automations.

TPM

In FY2025, the motorcycle and commercial vehicle divisions at the Waluj Plant received the ‘Advanced Special Award for TPM Achievement’ by JIPM (Japan Institute of Plant Maintenance). The Chakan plant had already been conferred with ‘World Class TPM Achievement’ in previous year. Bajaj Auto also received TPM Excellence Award — “TPM Excellent Case Study Commendation” — which has been established award by JIPM in FY2025.

Vendor TPM Activities

In FY2025, two vendor partners were honoured with JIPM awards, taking the total number of JIPM TPM awards winning vendors till date to 37. Groundwork done by Bajaj Auto and vendors for TPM implementation and the fact that the Bajaj TPM Excellence Awards has been awarded to 83 vendors demonstrates the strong alignment between the Company and its vendors in embracing TPM. With focus on responsible resource utilisation, 50 vendors have started using renewable energy and implemented rooftop solar plants that can produce 45 MW of power.

TPM in Dealer Service and Overseas Distributor Plants

Our TPM philosophy is also spread across Bajaj Auto’s supply chain encompassing our dealer network in India and international distributors across the globe.

Across our network in India, as on 31 March 2025, we had 1,217 dealerships practicing TPM; of these, 776 dealerships have been awarded with the ‘BAL TPM Award’. Over 80,000 kaizens are implemented with active involvement of dealer and distributor employees.

Five years ago, Bajaj Auto started TPM implementation at international distributor plants.

As of FY2025, 24 distributor plants have been practicing TPM. These plants are now experiencing major improvements in productivity, first-time-right quality and optimisation in cost parameters.

Capacity and Employee Strength

|

Table 5: Plant-wise Capacities (in units per annum) |

|||||

|

Plant |

As on 31 March 2025 |

Product Range |

|||

|

Waluj |

Motorcycles |

2,700,000 |

Boxer, CT, Platina, Discover, Freedom, Pulsar |

||

|

Commercial Vehicles |

1,020,000 |

Passenger Carriers, Good Carriers, Quadricycle |

|||

|

Chakan 1 |

Motorcycles |

900,000 |

Pulsar, Avenger, Dominar |

||

|

Chakan 2 |

Motorcycles |

300,000 |

KTM, Husqvarna, Triumph |

||

|

Chakan 1 / Akurdi |

Scooters |

480,000 |

Chetak, Yulu |

||

|

Pantnagar |

Motorcycles |

1,800,000 |

CT, Platina, Freedom and Pulsar |

||

|

7,200,000 |

|||||

As of 31 March 2025, BAL’s employee strength stood at 7,444. This excludes Bajaj Auto Technology Limited’s employee strength of 454. Our women employee strength has increased over 2.5 times in a decade — from 242 in FY2015 to 618 in FY2025. Almost 60% of the women are working in manufacturing plants and in engineering.

Human Resources (HR)

FY2025 has been another year of growth and transformation for the HR function at Bajaj Auto with efforts being focused around five core imperatives: (i) attracting and retaining top-tier talent, (ii) building new-age skills, (iii) identifying and nurturing leaders, (iv) fostering a culture of technology and innovation, and (v) improving employee experience, well-being and engagement.

Attracting and Retaining Top-Tier Talent

Our ability to attract highly skilled talent continues to strengthen. We recruit exclusively from top 10 IITs, top NITs and top 10 MBA institutes – with exclusive slots in over 90% of campuses and place significant emphasis on encouraging women candidates to apply to Bajaj Auto; 53% of our offers are made to women in STEM fields and are set to welcome first GTE batch of more women than men. To further deepen our engagement with these premier institutions, we launched the HR Pitstop event this year — an initiative aimed at building stronger campus connect and enhancing our employer brand.

Building New Age Skills

To drive sustained learning, provide global exposure and complement structured learning, we

a.Launched the “Bajaj Auto Academy of Excellence” — an initiative designed to build role-specific capabilities through structured training interventions.

b.Run LEAP program to enable employees to pursue work-integrated and international full-time masters and certification program, ensuring alignment with evolving industry demands.

c.Prioritized accessibility to cutting-edge knowledge through internal learning platform, BOLT.

Identifying and Nurturing Leaders

We believe that leadership development starts from within. Our focus is to identify and enable internal talent to grow into effective leaders across the organization. To this end, we

a.offer a structured growth journey that includes Development Centres, First-Time Manager Programs and targeted capability-building initiatives with emphasis on strengthening techno-managerial competencies.

b.launched iEMPOWER—a personalised coaching intervention designed to support leaders in expanding their influence and stepping onto larger roles.

Fostering a Culture of Technology and Innovation

To inspire innovation, empower talent and strengthen collaboration across industry and academia, we

a.hosted Bajaj Auto’s first Tech Conference “InnoVision” bringing together engineers, experts, and academic minds to explore topics like digital manufacturing, battery technology and AI.

b.launched LinkedIn Talent Insights GPT and Attrition Reports GPT — tools designed to provide increase data efficiency and enable faster analysis to help HR leaders identify trends, improve planning and take quicker decisions.

Improving Employee Experience, Well-Being and Engagement

FY2025 was the third consecutive year of our annual employee engagement survey, PULSE; 98% of our employees participated and 91% of employees expressing pride in working for Bajaj Auto. Based on the feedback, significant focus was placed on creating a ‘Culture of Recognition’.

Launched Bajaj Bytes, our employee magazine, to bring an inside-out perspective through stories of our corporate insights, technological leaps, manufacturing excellence and market breakthroughs.

We also celebrated The Mental Health Awareness Week, Womens Week and also focused on promoting healthy living, highlighting achievements, enhancing technical awareness while also highlighting the key qualities and skills required to become an effective leader.

In FY2025, Bajaj Auto was recognised for the fourth consecutive year as a ‘Company with Great Managers’, with nine of our managers being honoured at the Great Manager Awards 2024. Two women employees won Jombay’s 1000 Women Leaders Program, an initiative designed to cultivate and amplify women’s leadership. Nine of our employees won the Economic Times HR Emerging Leaders Award. Apart from these, our employees were recognised in multiple prestigious forums, including HR 30 Under 30 and HR 40 Under 40 awards.

Corporate Social Responsibility (CSR)

Within CSR, Bajaj Auto is building competence around selected areas that help focus on large-scale impact. Some of the key CSR initiative are

Skilling Initiatives

A.Bajaj Engineering Skills Training (BEST)

This initiative collaborates with top-ranked universities and engineering colleges to equip youth with the skills needed for employment. The goal is to establish state-of-the-art centres with world-class laboratories and equipment and allowing for hands-on training for engineers and diploma holders. Currently, there are five BEST centres operational across four states, with a total enrolment of 1,268 students, of which 31% are women.

B.Bajaj Manufacturing Systems (BMS) Certification program

This initiative aims to bridge the knowledge gap between the workforce and industry by providing insights into Total Productive Maintenance (TPM). It is a self-paced learning program consisting of nine BMS e-modules available on a user-friendly platform for ITI trainees. After a successful pilot, the program has expanded to Maharashtra, Uttarakhand, Karnataka, Gujarat, and Tamil Nadu, certifying a total of 15,004 students this year.

C.Service Technician Program (STEP)

This initiative aims to train freshers, 10th pass and above, seeking short-term vocational training to enhance their skills and career prospects in two-wheeler auto repair under ICE, CNG, and EV categories. The first STEP Centre was inaugurated at the CII-Rahul Bajaj Centre of Excellence on Skills, Chhindwara-Madhya Pradesh, in partnership with Ambuja Foundation as implementation partner and CII as infrastructure partner. The STEP program will now be expanded PAN India with a total of 57 centres to be set up, aiming to impact over 10,000 youth in the next three years.

Programs under Education

A.Supporting Youth Organization for Joining Action and Knowledge (YOJAK)

YOJAK offers an easily accessible platform tailored to the needs of disadvantaged students, particularly girls, empowering them with essential skills to pursue careers in STEM related fields. With 12 learning centres in Pune, YOJAK delivers academic excellence alongside experiential learning and social support. In FY2025, over 2,665 students from grades 8 to 12 received support.

B.Foundation of Advancing Science and Technology (FAST)

Dedicated to engage and inspire Indian civil society with the wonders of scientific exploration with primary focus on youth, particularly those considering or already pursuing science as a career. FAST endeavours to narrow the divide between science practitioners and the wider community. It hosted the India Science Connect 2025, where there were some 16,000 participants.

Programs under Environment Sustainability

A.Rupa Rahul Bajaj Centre of Environment and Arts (RRBCEA)

RRBCEA in Pune is dedicated to promoting environmental awareness through art. In FY2025, it conducted over 45 events, engaging more than 4,000 participants, including school children and youth. By collaborating with local organisations, RRBCEA nurtures a commitment to sustainability and climate action.

B.Canine Care and Control (CCC) & Blue Cross Society (BCS)

Canine Care and Control (CCC) and the Blue Cross Society (BCS) are focused on animal welfare through vaccination, sterilisation and adoption. In FY2025, CCC held 54 training sessions on dog bite prevention, organised 980 free anti-rabies vaccination drives, along with an animal birth control drive in Solapur; and completed 11,677 surgeries and vaccinations for dogs and cats. BCS provided 10,006 cats and dogs with free treatment at their outpatient department (OPD), with 835 treated in their inpatient department (IPD).

Programs under Health

A.PRANA

PRANA was established for promoting holistic health by integrating Homoeopathy and Yoga, along with Osteopathy, Chiropractic, Acupuncture, and Nutrition. Its comprehensive approach encompasses awareness, prevention, and treatment, impacting individuals of all ages. By spreading knowledge of holistic methods, PRANA empowers people to improve their well-being and effectively address various disorders.

B.PCCM

The Prashanti Cancer Care Mission (PCCM) is a registered public charitable trust based in Pune, dedicated to providing affordable medical treatment and rehabilitation for underprivileged breast cancer patients and their families. It has supported over 200 beneficiaries through various activities, including biopsies, surgeries, germline testing and microbiome/generic /transcriptomic profiling studies. In addition, PCCM has published four issues of the BreastGlobal Journal and conducted numerous awareness talks and webinars to advance knowledge and support for breast cancer patients.

Financials

|

Table 6 gives the summarised standalone profit and loss statement of Bajaj Auto. Table 6: Summarised Standalone Profit and Loss Statement, Bajaj Auto, FY2025 |

||||||

|

(₹ In Crore) |

||||||

|

Particulars |

FY2025 |

FY2024 |

Growth% |

|||

|

Operations |

||||||

|

Sales |

48,247 |

43,579 |

10.7% |

|||

|

Other operating income |

1,763 |

1,106 |

||||

|

Total operating income |

50,010 |

44,685 |

11.9% |

|||

|

Cost of materials consumed; net of expenditures capitalised |

35,287 |

31,696 |

||||

|

70.6% |

70.9% |

|||||

|

Stores and tools |

199 |

172 |

||||

|

0.4% |

0.4% |

|||||

|

Employee cost |

1,577 |

1,536 |

||||

|

3.2% |

3.4% |

|||||

|

Factory, administrative and other expenses |

1,399 |

1,216 |

||||

|

2.8% |

2.7% |

|||||

|

Sales and after sales expenses |

1,447 |

1,240 |

||||

|

2.9% |

2.8% |

|||||

|

Total expenditure |

39,909 |

35,860 |

||||

|

Earnings before interest, tax, depreciation and amortisation (EBITDA) |

10,101 |

8,825 |

14.5% |

|||

|

20.2% |

19.7% |

|||||

|

Interest |

68 |

54 |

||||

|

Depreciation & amortisation |

400 |

349 |

||||

|

Operating profit |

9,633 |

8,422 |

14.4% |

|||

|

19.3% |

18.8% |

|||||

|

Non-operating income |

1,421 |

1,402 |

||||

|

Less : Non-operating expense |

2 |

2 |

||||

|

Non-operating income, net |

1,419 |

1,400 |

||||

|

Profit before tax |

11,052 |

9,822 |

12.5% |

|||

|

Tax expense |

2,690 |

2,343 |

||||

|

Tax expense (exceptional item)* |

211 |

|||||

|

Profit after tax |

8,151 |

7,479 |

9.0% |

|||

*One-time exceptional charge on withdrawal of indexation and change in tax rate (Finance Act, 2024).

Our surplus funds are invested in (i) fixed income securities rated A1+ and equivalent for short term investments, (ii) AA+ and above rated securities for long term investments, and (iii) fixed deposits with banks and finance companies.

As required for listed companies by Securities and Exchange Board of India, Table 7 gives the key ratios.

|

Table 7: Bajaj Auto’s Key Financial Ratios, Standalone |

||||||

|

Particulars |

FY2025 |

FY2024 |

Remarks |

|||

|

Debtors Turnover Ratio |

21.91 |

22.36 |

|

|||

|

Inventory Turnover Ratio |

19.34 |

20.52 |

|

|||

|

Current Ratio |

1.49 |

1.19 |

Increase in current assets due to investment & inventory |

|||

|

Operating Profit Margin |

19.30% |

18.80% |

|

|||

|

Net Profit Margin |

15.80% |

16.20% |

|

|||

|

Debt-Equity Ratio |

0.02 |

0.03 |

Due to increase in other equity |

|||

|

Return on Equity |

28.60% |

29.70% |

|

|||

Subsidiaries

Bajaj Auto International Holdings BV (BAIH BV)

Bajaj Auto International Holdings BV (BAIH BV) is a 100% Netherlands based subsidiary of Bajaj Auto Limited. Over the years, through this subsidiary, Bajaj Auto has invested a total of €198.1 million (₹ 1,219 crore) and holds 49.9% stake in Pierer Bajaj AG (PBAG).

Pierer Bajaj AG holds 74.9% stake in Pierer Mobility AG (PMAG), which apart from other stakes, also holds 100% stake in KTM AG, the leading manufacturer of offroad and street motorcycles marketed under the marquee brands of KTM, Husqvarna and GASGAS. Thus, Bajaj Auto effectively is a partner in all mobility businesses.

In the year 2024, PBAG clocked revenue in excess of €1.9 billion and a loss of €1080 million.

On 28 November 2024, KTM AG applies for the initiation of judicial restructuring proceedings with self-administration over the assets of KTM AG and its two subsidiaries with an aim to agree a reorganization plan with the creditors within 90 days. On 25 February 2025, the creditors accepted the restructuring plan submitted by KTM AG. This plan provided for creditors to receive a cash quota of 30% of their claims in the form of a one-time payment to be deposited with the restructuring Administrator by 23 May 2025. On 22 May 2025, Bajaj Auto Ltd, through its wholly owned subsidiary, BAIHBV, intends to acquire a sole controlling stake in PBAG and secured a debt package of €800 million to meet the immediate liquidity need of creditors to receive cash quota and restart operations, subject to necessary regulatory approvals.

Bajaj Do Brasil Comercio De Motocicletas Ltda

Bajaj Do Brasil is a wholly owned subsidiary with an issued and subscribed share capital of BRL 58 million (₹ 94 crore). The subsidiary was set up to operate in the highly competitive market of Brazil, the size of which is close to 2 million units with SMC market representing ~43%.

In CY2024, Bajaj Do Brasil sold over 13,000 units — threefold increase compared to over 4,300 units sold in CY2023. A key enabler of this performance was the successful commencement of operations at the dedicated manufacturing facility in Manaus, the company’s first plant with an annual capacity of 20,000 units outside India. This facility produced ~9,000 motorcycles during the second half of the year, contributing to supply chain efficiency and cost optimization. Dealership network also saw rapid expansion, from 10 outlets across 6 states in 2023 to 31 outlets across 17 states by the end of 2024, significantly improving national coverage.

Bajaj Auto Technology Limited (erstwhile Chetak Technology Limited)

Bajaj Auto Technology Limited (BATL) formed on 4 October 2021, stands adequately funded with paid-up equity share capital of ₹ 470 crore as on 31 March 2025. BATL is focussed on creating new disruptive / cutting edge technology and products.

In FY2025, BATL subsystems enabled successful upgradation in Chetak EV with Floorboard Battery and optimised powertrain and Integrated Motor + MCU along with substantial cost reduction. The team is also working towards evaluation of alternate winding configurations / topologies to improve motor performance and developing technologies to reduce dependence on import for magnets.

BATL team has filed for 12 patents in FY2025 in multiple areas of component and vehicle integration.

Bajaj Auto Credit Limited (BACL)

Bajaj Auto Credit Ltd. is a wholly owned captive financing subsidiary with an issued and subscribed share capital of ₹ 2,400 crore. With ~65-75% of two-wheelers and three-wheelers retailed in India being financed, this activity is the key to Bajaj Auto’s business to increase geographic coverage and expand financing options for the retail customers.

BACL received its Certificate of Registration from the Reserve Bank of India on 29 August 2023; and officially launched its operations on 01 January 2024. The Company successfully navigated its business transition from Bajaj Finance Ltd and has built a healthy portfolio. It now operates across all geographies in India.

FY2025, BACL performance highlights were as follows:

●Assets under management (AUM) as of 31 March 2025 crossed ₹ 9,300 crore.

●Disbursement for FY2025 in excess of ₹ 10,000 crore – number of new loans was over 751,000.

●Net interest income (NII) stood at ₹ 852 crores.

●Profit before tax (PBT) was at ₹ 78 crore and Profit after tax (PAT) was ₹ 58 crores.

●Gross Non-Performing Assets (GNPA) at 0.80%; Net Non-Performing Asset (NNPA) at 0.44%.

●Capital adequacy ratio as on 31 March 2025 was 23.37% and Tier-I adequacy was 23.18% — which are both well above the RBI norms of 15%.

On the liability side, BACL continued to maintain conservative liquidity buffers. The consolidated liquidity buffer was ₹ 1,046 crore as on 31 March 2025, excluding undrawn lines. BACL has a rating of AAA stable from CRISIL, India Ratings and CARE

Bajaj Auto (Thailand) Limited

Bajaj Auto (Thailand) Ltd. is a wholly owned subsidiary in Bangkok, Thailand with an issued and subscribed share capital of Thai Baht (THB) 45 million (₹ 10 crore). The subsidiary has set up an Engineering Design Centre (EDC), to expand R&D’s reach to trend defining markets and tap internationally available best designers. It has all necessary approvals from local authorities.

Bajaj Auto Spain S.L.U.

Bajaj Auto Spain S.L.U. is a wholly owned subsidiary in Barcelona, Spain, with an issued and subscribed share capital of €600K (₹ 5 crore). The subsidiary has set up an Engineering Design Centre (EDC), again, to expand R&D’s reach and tap internationally available best designers. With all necessary approvals from local authorities, this EDC is now fully operational.

Consolidation of accounts and segment reporting

Table 8 gives the numbers.

|

Table 8: Segment Revenue and Segment Results |

||||

|

(₹ In Crore) |

||||

|

Segment Revenue |

FY2025 |

FY2024 |

||

|

Automotive |

49.982 |

44,870 |

||

|

Financing |

1,041 |

17 |

||

|

Investment and others |

1,446 |

1,419 |

||

|

52,469 |

46,306 |

|||

|

Segment Results Profit / (Loss) from each segment before tax |

||||

|

Automotive |

8,770 |

8,708 |

||

|

Financing |

78 |

(25) |

||

|

Investment and others |

1,444 |

1,417 |

||

|

10,292 |

10,100 |

|||

|

Less : Interest |

68 |

60 |

||

|

Profit before tax |

10,224 |

10,040 |

||

|

Profit after tax |

7,325 |

7,708 |

||

Cautionary Statement

Statements in this Management Discussion and Analysis describing the Company’s objectives, projections, estimates and expectations may be ‘forward looking’ within the meaning of applicable laws and regulations. Actual results may differ from those expressed or implied. Important factors that could make a difference to the Company’s operations include global economy, political stability, stock performance on stock markets, changes in government regulations, tax regimes, economic developments and other incidental factors. Except as required by law, the Company does not undertake to update any forward-looking statements to reflect future events or circumstances. Investors are advised to exercise due care and caution while interpreting these statements.