17th Annual General Meeting (AGM)

|

Date |

16 July 2024 |

|

|

Day |

Tuesday |

|

|

Time |

2:00 PM |

|

|

Venue/Mode |

Registered office at Mumbai-Pune Road, Akurdi, Pune 411035 |

|

|

Remote e-voting starts |

Friday, 12 July 2024 at 9:00 a.m. |

|

|

Remote e-voting ends |

Monday, 15 July 2024 at 5:00 p.m. |

|

|

E-voting at AGM |

Tuesday, 16 July 2024 |

|

|

Financial Year |

1 April to 31 March |

Live webcast of the AGM

Pursuant to regulation 44(6) of the SEBI Regulations, 2015, top 100 listed entities shall, with effect from 1 April 2019, provide one-way live webcast of the proceedings of their AGM. Accordingly, as in the previous year, the Company has entered into an arrangement with KFin to facilitate live webcast of the proceedings of the ensuing 17th AGM scheduled on 16 July 2024.

Voting through electronic means

Pursuant to section 108 of the Act and the Rules made thereunder and provisions under the SEBI Listing Regulations, 2015, every listed company is required to provide its members, the facility to exercise their right to vote at general meetings by electronic means.

The Company has entered into an arrangement with KFin as the authorised agency for this purpose, to facilitate such e-voting for its members.

The shareholders will therefore be able to exercise their voting rights on the items put up in the Notice of AGM, through e-voting. Further, in accordance with the Companies (Management and Administration) Rules, 2014 and MCA circulars, the Company will also be making arrangements to provide for e-voting facility at the venue of the Annual General Meeting.

Shareholders, who are attending the meeting and who have not already cast their votes by remote e-voting shall only be able to exercise their right of voting at the meeting.

The cut-off date, as per the said Rules, shall be 9th July 2024 and the remote e-voting shall be open for a period of four days, from 12 July 2024 (9.00 a.m.) till 15 July 2024 (5.00 p.m.). The Board has appointed Shyamprasad D Limaye, Practising Company Secretary as the scrutiniser for the e-voting process.

The detailed procedure is given in the Notice of the 17th AGM and is also placed on the Company’s website at https://www.bajajauto.com/investors/financial-and-operational-performance

Financial calendar

|

Approval of audited annual results for year ending 31 March |

April/May |

|

|

Mailing of Annual Reports |

June |

|

|

Annual general meeting |

July |

|

|

Unaudited first quarter financial results |

July |

|

|

Unaudited second quarter financial results |

October |

|

|

Unaudited third quarter financial results |

January/early February |

Share transfer agent

The Company has appointed KFin Technologies Ltd. (KFin), as its registrar and share transfer agent for processing of share transfer/dematerialisation/rematerialisation and allied activities.

All physical transfers (to the extent permitted), transmission, transposition, issue of duplicate share certificate(s), issue of demand drafts in lieu of dividend warrants, etc. as well as requests for dematerialisation/rematerialisation are being processed in periodical cycles at KFin. Work related to dematerialisation/rematerialisation is handled by KFin through connectivity with National Securities Depository Ltd. (NSDL) and Central Depository Services (India) Ltd. (CDSL).

Review of service standards adhered by KFin with respect to share related activities

The Company has agreed service timelines and standards for various shareholder-related service with KFin. On an on-going basis, the secretarial team engages with officials of KFin at various levels for review of these standards. Periodic meetings and discussions are held to understand the concerns of shareholders, deviations, if any, in the timelines for processing service requests, best practices and other measures to strengthen shareholder-related services.

Record date

The Company has fixed Friday, 14 June 2024 as the ‘Record Date’ for the purpose of determining the members eligible to receive dividend for the financial year 2023-24.

Dividend and date of dividend payment

The Board of directors has proposed a dividend of ₹ 80 per equity share (800%) of the face value of ₹ 10 for the financial year 2023-24, subject to approval of members at the ensuing AGM.

Dividend on equity shares, if declared, at the AGM, will be credited/dispatched on Friday, 19 July 2024, as under:

a.to all those shareholders holding shares in physical form, as per the details provided to the Company by the share transfer agent of the Company i.e., KFin, as of the closing hours of the day on Friday, 14 June 2024 and

b.to all those beneficial owners holding shares in electronic form as per beneficial ownership details provided to the Company by NSDL and CDSL, as of the closing hours of the day on Friday, 14 June 2024.

Payment of dividend

The SEBI Listing Regulations, 2015 read with SEBI Master circular dated 17 May 2023, require companies to use any electronic mode of payment approved by the Reserve Bank of India (RBI) for making payment to shareholders. Accordingly, the dividend, if declared, will be paid through electronic mode, where the bank account details of the members are available.

Where dividend payments are made through electronic mode, intimation regarding such remittance will be sent separately to the shareholders.

In cases where either the bank details such as MICR (Magnetic Ink Character Recognition), IFSC (Indian Financial System Code), etc. that are required for making electronic payment are not available or the electronic payment instructions have failed or have been rejected by the bank, the dividend will be paid by account payee non-negotiable instruments / warrants/cheques with bank account details printed thereon. In case of non-availability of bank account details, address of the members will be printed on such payment instruments.

A) For Physical Shareholders: As per SEBI vide its Circular SEBI/HO/MIRSD/MIRSD-PoD-1/P/CIR/2023/37 dated 16 March 2023 and Master circular SEBI/HO/MIRSD/POD-1/P/CIR/2023/70 dated 17 May 2023, the members holding security in physical form, whose folio(s) do not have KYC details updated shall be eligible for payment of dividend in respect of such folio(s), only through electronic mode with effect from 01 April 2024. For the purpose of updation of KYC details against folio, members are requested to send the details through ISR-1 (to update PAN, address, email address and bank account details), ISR-2 (Specimen Signature), ISR-3 (for opting out of Nomination) and SH-13 (Nomination registration form). The said forms are available at https://www.bajajauto.com/investors/miscellaneous

Pursuant to the SEBI FAQs dated 4 January 2024, on and from 01 April 2024 onwards, in case of non-updation of PAN, Choice of Nomination, Contact Details including Mobile Number, Bank Account Details and Specimen Signature, listed companies shall send an intimation to the security holder that such payment is due and shall be made electronically upon furnishing PAN, Choice of Nomination, Contact Details including Mobile Number, Bank Account Details and Specimen Signature. Meanwhile, such unpaid dividends shall be kept by the listed companies in the Unpaid Dividend Account in terms of the Companies Act, 2013.

Further, the RTA shall, suo-moto, generate request to the company’s bankers to pay electronically, all the dividends to the holder that were previously unclaimed / unsuccessful once PAN, Choice of Nomination, Contact Details including Mobile Number, Bank Account Details and Specimen Signature are updated by the Members.

Also, pursuant to above mentioned SEBI circulars, listed companies shall directly intimate its physical security holders about folios which are incomplete with regards to KYC on an annual basis within six months from the end of the financial year.

In view of the above, the Company has sent communication to 455 shareholders (holding securities in physical form), whose folio(s) are not updated with the KYC details.

B) For Demat Shareholders: Members holding shares in demat form are requested to update their bank account details with their respective Depository Participants (‘DPs’). The Company or KFin cannot act on any request received directly from the Members holding shares in demat form for any change of bank particulars. Such changes are to be intimated only to the DPs of the Members.

Shareholders are requested to ensure that their bank account details in their respective demat accounts are updated to enable the Company to provide timely credit of dividend in their bank accounts.

Tax deducted at source (TDS) on dividend

Pursuant to the changes introduced by the Finance Act, 2020, w.e.f. 1 April 2020 as in the previous year, there will be no Dividend Distribution Tax payable by the Company. The dividend, if declared, will be taxable in the hands of the shareholders subject to tax deduction at source at the applicable rates. The TDS rate would vary depending on the residential status of the shareholders and the documents submitted by them and accepted by the Company. For the detailed process and formats of declaration, please refer to FAQs on Tax Deduction at Source on Dividends available on the Company’s website at https://www.bajajauto.com/investors/dividend

Unclaimed dividends

As per section 124(5) of Companies Act, 2013, any money transferred by the Company to the unpaid dividend account and remaining unclaimed for a period of seven years from the date of such transfer shall be transferred to a fund called the Investor Education and Protection Fund (the ‘Fund’) set up by the Central Government.

Accordingly, unpaid/unclaimed dividend for the financial years 2007-08 to 2015-16 has been already transferred by the Company to this said Fund from September 2015 onwards.

Unclaimed dividend amounting to ₹ 1,616,140/- in respect of financial year 2015-16 (final) was transferred to the Fund in compliance with the provisions of Section 125 of the Act in September 2023.

Unpaid/unclaimed dividend for the financial year 2016-17 shall be due for transfer to the Fund in August/September 2024. Members are requested to verify their records and send their claim, if any, for the 2016-17 before such amount become due for transfer. Communications are being sent to members, who have not yet claimed final dividend for 2016-17, requesting them to claim the same as well as unpaid dividend, if any, for subsequent years.

As a measure to reduce the unclaimed dividend, efforts are being made on an ongoing basis to reach out to shareholders requesting them to submit necessary documents to enable them to claim their unpaid or unclaimed dividend.

The following are the details of unclaimed dividends which are due to be transferred to the Fund in the coming years including current year. Once again, members who have not claimed the dividends till date are requested to verify their records and send their claim, if any, before the same becomes due for transfer as per the table given below:

|

Year |

Dividend Type |

Date of Declaration AGM Date |

Last date for claiming dividend |

Due date for transfer |

||||

|

2016-2017 |

Final |

20 July 2017 |

18 August 2024 |

17 September 2024 |

||||

|

2017-2018 |

Final |

20 July 2018 |

18 August 2025 |

17 September 2025 |

||||

|

2018-2019 |

Final |

26 July 2019 |

24 August 2026 |

23 September 2026 |

||||

|

2019-2020 |

Interim |

09 March 2020 |

07 April 2027 |

06 May 2027 |

||||

|

2020-2021 |

Final |

22 July 2021 |

20 August 2028 |

19 September 2028 |

||||

|

2021-2022 |

Final |

26 July 2022 |

25 August 2029 |

24 September 2029 |

||||

|

2022-2023 |

Final |

25 July 2023 |

24 August 2030 |

23 September 2030 |

The Company has uploaded details of unclaimed dividend on its website at https://www.bajajauto.com/investors/dividend and also on website specified by the Ministry of Corporate Affairs https://www.iepf.gov.in/IEPFWebProject/services.html

Initiatives for reduction of unclaimed dividend

The Company with a view to reducing the quantum of unclaimed dividend has undertaken several steps as was done in the last few years. These primarily included proactively reaching out to shareholders, sending periodic communications, advising the shareholders who approach the Company/KFin for other service request to claim their dividend, if any and remitting unpaid dividend, if any for KYC compliant folios. The amount is remitted based on the verification of the documents and bonafides of the claim.

Transfer of shares to IEPF

Pursuant to section 124(6) of Companies Act, 2013 and the Investor Education and Protection Fund Authority (Accounting, Audit, Transfer and Refund) Rules, 2016, as amended (the ‘IEPF Rules’), all shares in respect of which dividend has not been paid or claimed for seven consecutive years or more shall be transferred by the Company to the IEPF, within 30 days of such shares becoming due for transfer.

Accordingly, the Company will send individual letters through ordinary/speed post and e-mail to such shareholders, whose dividend from the year 2016-17 has remained unclaimed, requesting them to claim the amount of unpaid dividend on or before the date on which Company must transfer the related shares to the demat account of IEPF. The Company also publishes, on an annual basis, a notice in the newspapers intimating the members regarding the said transfer. These details are also be made available on the Company’s website https://www.bajajauto.com/investors/disclosures

During the year under review, the Company transferred 4221 (previous year: 8621) equity shares of the face value of ₹ 10 each relating to 34 shareholders (previous year: 28) to the demat account of the IEPF Authority held with NSDL/CDSL. Details of such shareholders, whose shares are transferred to IEPF and their unpaid dividends for subsequent years are available on the website of the Company at https://www.bajajauto.com/investors/dividend

Shareholders can claim such unpaid dividends and underlying shares transferred to the Fund by following the procedure prescribed in the IEPF Rules. A link to the procedure to claim is available on the Company’s website at https://www.bajajauto.com/investors/miscellaneous

Shareholders are requested to get in touch with the compliance officer for further details on the subject at investors@bajajauto.co.in

Share Transfer System

SEBI’s amended regulation 40 of the Listing Regulations, 2015, prohibits the transfer of securities (except transmission or transposition of shares) in physical form from 1 April 2019. Accordingly, the Company has sent letters to members holding shares in physical form advising them to dematerialise their holdings.

SEBI vide its circulars dated 25 January 2022 and 25 May 2022 has provided the guidelines to issue the securities in dematerialised form by issuing a ‘Letter of Confirmation’ in lieu of physical securities certificates to the securities holder/Claimant within 30 days of its receipt of such request after removing objections, if any.

Share transfers received by the share transfer agent/Company are registered within 15 days from the date of receipt, provided the documents are complete in all respects. The total number of shares transferred by issuing letter of confirmations during 2023-24 due to transmission/deletion of name cases were 53,905 shares versus 54,604 shares during 2022-23. Such details were placed before the Board on a quarterly basis.

Dematerialisation/Rematerialisation of shares

During 2023-24,10,17,643 shares were dematerialised versus 1,48,29,398 shares in 2022-23. Nil shares were rematerialized during 2023-24 versus Nil shares in 2022-23. Shares held in physical and electronic mode as on 31 March 2024 are in Table 1.

|

Table 1: Shares held in physical and electronic mode |

||||||||||||

|

Position as on 31 March 2024 |

Position as on 31 March 2023 |

Net change during 2023-24 |

||||||||||

|

Particulars |

No. of shares |

% to total shareholding |

No. of shares |

% to total shareholding |

No. of shares |

% to total shareholding |

||||||

|

Physical |

942,347 |

0.34 |

1,965,675 |

0.69 |

(1,023,328) |

(0.35) |

||||||

|

Demat |

||||||||||||

|

NSDL |

205,056,022 |

73.45 |

210,066,086 |

74.24 |

(5,010,064) |

(0.79) |

||||||

|

CDSL |

73,181,387 |

26.21 |

70,925,597 |

25.06 |

2,255,790 |

1.14 |

||||||

|

Sub-total |

278,237,409 |

99.66 |

280,991,683 |

99.31 |

(2,754,274) |

0.35 |

||||||

|

Total |

279,179,756 |

100 |

282,957,358 |

100 |

(3,777,602) |

– |

||||||

Stock code

|

1. BSE Ltd., Mumbai |

532977 |

|

|

2. National Stock Exchange of India Ltd. |

BAJAJ-AUTO |

|

|

3. ISIN for depositories (NSDL and CDSL) |

INE917I01010 |

|

|

4. Bloomberg |

BJAUT.IN |

|

|

5. Reuters |

BAJA.BO |

Listing on stock exchanges

Shares of the Company are currently listed on the following stock exchanges:

|

Name |

Address |

|

|

1. BSE Ltd. (BSE) |

1st Floor, New Trading Ring Rotunda Building, P J Tower Dalal Street, Fort, Mumbai 400 001. |

|

|

2. National Stock Exchange of India Ltd. (NSE) |

Exchange Plaza, 5th Floor Plot No.C-1, G Block Bandra-Kurla Complex Bandra (East), Mumbai 400 051. |

Pursuant to the SEBI Listing Regulations, 2015 the Company has entered into a Uniform Listing Agreement with BSE and NSE. For FY2024, the listing fees payable to these stock exchanges have been paid in full.

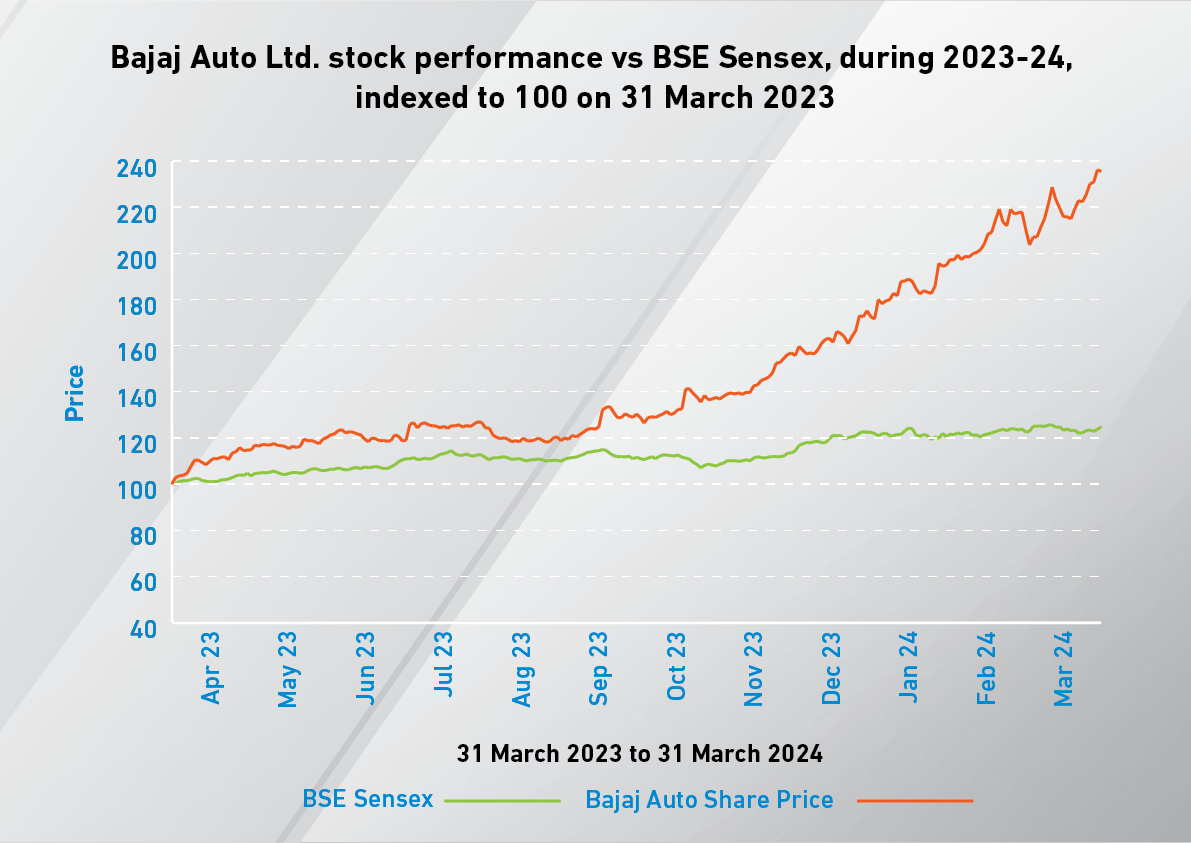

Market price data

|

Table 2: Monthly highs and lows of Company’s shares in FY2024 (₹ vis-à-vis BSE Sensex) |

||||||||||

|

BSE |

NSE |

Closing BSE Sensex |

||||||||

|

Month |

High |

Low |

High |

Low |

||||||

|

April-2023 |

4,439.40 |

3,890.30 |

4,439.70 |

3,888.20 |

61,112.44 |

|||||

|

May-2023 |

4,663.90 |

4,427.30 |

4,664.55 |

4,424.05 |

62,622.24 |

|||||

|

June-2023 |

4,828.80 |

4,526.35 |

4,829.90 |

4,567.25 |

64,718.56 |

|||||

|

July-2023 |

4,988.55 |

4,582.05 |

4,995.10 |

4,588.05 |

66,527.67 |

|||||

|

August-2023 |

4,978.00 |

4,544.00 |

4,978.65 |

4,541.00 |

64,831.41 |

|||||

|

September-2023 |

5,272.20 |

4,613.30 |

5,274.90 |

4,619.00 |

65,828.41 |

|||||

|

October-2023 |

5,514.65 |

4,902.80 |

5,510.00 |

4,903.05 |

63,874.93 |

|||||

|

November-2023 |

6,128.90 |

5,286.00 |

6,128.90 |

5,285.00 |

66,988.44 |

|||||

|

December-2023 |

6,832.75 |

5,990.05 |

6,833.95 |

5,987.85 |

72,240.26 |

|||||

|

January-2024 |

7,682.15 |

6,560.05 |

7,686.00 |

6,560.95 |

71,752.11 |

|||||

|

February-2024 |

8,650.00 |

7,635.40 |

8,650.00 |

7,633.50 |

72,500.30 |

|||||

|

March-2024 |

9,284.65 |

7,959.00 |

9,287.80 |

7,945.30 |

73,651.35 |

|||||

Distribution of shareholding

Table 3 gives details about the pattern of shareholding across various categories as on 31 March 2024, while Table 4 gives the data according to size classes.

|

Table 3: Distribution of shareholdings across Categories |

||||||||

|

As on 31 March 2024 |

As on 31 March 2023 |

|||||||

|

Categories |

No. of shares |

% to total capital |

No. of shares |

% to total capital |

||||

|

Promoters |

153,708,367 |

55.06 |

155,580,309 |

54.98 |

||||

|

FPIs/FIIs |

40,545,549 |

14.52 |

34,974,488 |

12.36 |

||||

|

Mutual Funds |

13,985,332 |

5.01 |

10,040,695 |

3.55 |

||||

|

Nationalised and other banks |

18,229 |

0.01 |

19,559 |

0.01 |

||||

|

NRIs and OCBs |

1,900,769 |

0.68 |

1,680,003 |

0.59 |

||||

|

Others |

69,021,510 |

24.72 |

80,662,504 |

28.51 |

||||

|

Total |

279,179,756 |

100.00 |

282,957,358 |

100.00 |

||||

|

Table 4: Distribution of shareholding according to size class as on 31 March 2024 |

||||||||

|

No. of shareholders |

Shares held in each class |

|||||||

|

Category |

Number |

% |

Number |

% |

||||

|

1 to 500 |

298,055 |

97.79 |

5,496,725 |

1.97 |

||||

|

501 to 1000 |

2,168 |

0.71 |

1,592,909 |

0.57 |

||||

|

1001 to 2000 |

1,422 |

0.47 |

2,066,488 |

0.74 |

||||

|

2001 to 3000 |

664 |

0.22 |

1,650,679 |

0.59 |

||||

|

3001 to 4000 |

388 |

0.13 |

1,367,072 |

0.49 |

||||

|

4001 to 5000 |

291 |

0.10 |

1,321,247 |

0.47 |

||||

|

5001 to 10000 |

621 |

0.20 |

4,406,629 |

1.58 |

||||

|

10001 to 20000 |

410 |

0.13 |

5,801,928 |

2.08 |

||||

|

20001 and above |

764 |

0.25 |

255,476,079 |

91.51 |

||||

|

Total |

304,783 |

100.00 |

279,179,756 |

100.00 |

||||

Shareholders’ and investors’ grievances

The Board of Directors of the Company has a Stakeholders Relationship Committee to specifically look into and resolve grievances of security-holders on various matters.

Routine queries/complaints received from shareholders are promptly attended to and replied. Queries/complaints received during FY2024 were relating to non-receipt of dividend by warrants as well as through electronic clearing service, TDS matters, clarification on holdings, non-receipt of Annual Report and change of address and/or bank particulars. As on 31 March 2024, there was no pending issue to be addressed or resolved.

During the year, letters were received from SEBI/Registrar of Companies (ROC)/Stock Exchanges/Investors concerning nineteen complaints filed by the shareholders on various matters. For each of these complaints, replies were sent to SEBI/ROC/Stock Exchanges/Investors in the prescribed format and no action remained to be taken on the Company’s side at the year end.

Green initiative

The Company believes in driving environmental initiatives. As a step in this direction, it availed of special services offered by NSDL/CDSL to update email addresses of shareholders holding shares with depository participant registered with these entities and who have not registered their email addresses. This will enable such shareholders to immediately receive various email communication from the Company from time to time including the Annual Report, dividend credit intimation etc. Shareholders who have not updated their email, are requested to do so by sending a request to the Company/KFin or their respective depository participant.

Also, the company has availed of the special services offered by NSDL/CDSL for sending SMS per demat account where email address is not registered.

Demat suspense account with HDFC Bank for unclaimed shares

In accordance with the provisions contained in clause 5A of the erstwhile Listing Agreement (corresponding to regulation 39(4) of the SEBI Listing Regulations, 2015) as amended by SEBI through its circular dated 16 December 2010, the Company, during 2011-12, had sent three reminders to such shareholders whose shares were lying ‘undelivered/unclaimed’ with the Company; and then followed it by opening of the unclaimed share suspense demat account titled ‘Bajaj Auto Ltd. – Unclaimed Suspense Account’ with the HDFC Bank in April 2012.

After completing the necessary formalities, 44,375 shares held by 148 shareholders were transferred to this suspense account in April 2012. Voting rights on such shares remain frozen till the rightful owner claims these shares.

The Company, acting as a trustee in respect of the unclaimed shares, follows the modalities for the operation of the said account in the manner set out in regulation 39(4) of the SEBI Listing Regulations, 2015.

The summary of this account for FY2024 is as follows:

|

Sr. No. |

Particulars |

No. of shareholders |

No. of shares |

|||

|

i. |

Aggregate no. of shareholders and the outstanding shares lying in the Unclaimed Suspense Account as on 1 April 2023 |

20 |

2192 |

|||

|

ii. |

No. of shareholders who approached the Company for transfer of shares from the Unclaimed Suspense Account during the year 2023-24 |

Nil |

Nil |

|||

|

iii. |

No. of shareholders to whom shares were transferred from the Unclaimed Suspense Account during the year 2023-24 |

Nil |

Nil |

|||

|

iv. |

No. of shares transferred to IEPF Authority during the year 2023-24 |

Nil |

Nil |

|||

|

v. |

Aggregate no. of shareholders and the outstanding shares lying in the Unclaimed Suspense Account as on 31 March 2024 |

20 |

2192 |

Certifications obtained from Practising Company Secretary

The Company has inter-alia obtained following certifications by the Practising Company Secretary for share-related matters, as per details given below:

|

Regulation |

Frequency |

|

|

Regulation 40 (9) of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 regarding Compliance of lodgment of transfers, sub-division, consolidation etc. |

Annual |

|

|

Reconciliation of Share Capital under Regulation 76 of SEBI (Depositories and Participants) Regulations, 2018 |

Quarterly |

Nomination

Individual shareholders holding shares singly or jointly in physical form can nominate a person in whose name the shares shall be transferable in the case of death of the registered shareholder(s) to avoid the lengthy process of Transmission of shares.

Details of nomination shall be furnished through hard copy or electronic mode with e-signatures as follows:

i.Either,

●Nomination through Form SH-13 as provided in the Rules 19(1) of Companies (Shares capital and debenture) Rules, 2014 or

● ‘Declaration to Opt-out’, as per Form ISR-3

ii.In case of cancellation of nomination by the holder(s) through Form SH-14, ‘Declaration to Opt-out’ shall be provided by the shareholder(s)

iii.Securities holder(s) can change their nominee through Form SH-14

Nomination facility for shares held in electronic form is also available with depository participant.

The said forms are available on the website of the Company at https://www.bajajauto.com/investors/miscellaneous

Issuance of Securities in dematerialised form in case of Investor Service Requests

Pursuant to SEBI vide its circular SEBI/HO/MIRSD/MIRSD_RTAMB/P/CIR/2022/8 dated January 25, 2022 has introduced common and simplified norms for processing investors’ service request by RTAs and norms for furnishing PAN, KYC details and Nomination and has mandated that the listed Companies shall henceforth issue the securities in dematerialized form only, while processing the following service requests:

●Issue of Duplicate securities certificate;

●Claim from Unclaimed Suspense account;

●Renewal/Exchange of securities certificate;

●Endorsement;

●Sub-division/Splitting of securities certificate;

●Consolidation of securities certificates/folios;

●Transmission;

●Transposition

For enabling the shareholders to demat their securities, the Registrar and Share transfer Agent shall issue a ‘Letter of Confirmation’ in lieu of physical share certificates to physical shareholders for enabling them to dematerialise the securities.

Further, SEBI vide its circular SEBI/HO/MIRSD/MIRSD-PoD-1/P/CIR/2023/37 dated 16 March 2023 (now rescinded due to issuance of Master Circular dated 17 May 2023) has, inter alia, mandated that any service request shall be entertained only upon registration of PAN, KYC details and nomination.

All holders of physical securities of the Company are mandatorily required to furnish the following documents/details to the RTA i.e., KFin Technologies Ltd. (KFin):

|

Form |

Purpose |

|

|

Form – ISR – 1 |

For registering PAN, KYC details or changes/updation |

|

|

Form – ISR – 2 |

Confirmation of Signature of securities holder by the Banker |

|

|

Form – ISR – 3 |

Opting out of Nomination by physical securities holders |

|

|

Form – SH – 13 |

Nomination form |

|

|

Form – SH – 14 |

Cancellation or Variation of Nomination |

The said forms are available on the Company’s website https://www.bajajauto.com/investors/miscellaneous

Simplification of Procedure of Transmission of Securities

SEBI has notified vide its circular SEBI/HO/MIRSD/MIRSD_RTAMB/P/CIR/2022/65 dated 18 May 2022, (now rescinded due to issuance of Master Circular dated 17 May 2023) has enhanced the monetary limits for simplified documentation for transmission of securities, allowed ‘Legal Heirship Certificate or equivalent certificate’ as one of the acceptable documents for transmission and provided clarification regarding acceptability of Will as one of the valid documents for transmission of securities. The said circular also specified the formats of various documents which are required to be furnished for the processing of transmission of securities.

The circular also lays down operational guidelines for processing investors’ service request for the purpose of transmission of securities. The procedure provided in this circular is duly followed by our registrar and share transfer agent while processing of transmission service request.

Simplification of Procedure for issuance of Duplicate Share Certificates

SEBI vide its circular SEBI/HO/MIRSD/MIRSD_RTAMB/P/CIR/2022/70 dated 25 May 2022 (now rescinded due to issuance of Master Circular dated 17 May 2023) has standardized the documents to be submitted for processing of service request for issue of duplicate share certificate and also laid down operational guidelines for the same.

Further, the said circular also mandates listed company to take special contingency policy from insurance company towards the risk arising out of the requirements relating to issuance of duplicate securities in order to safeguard and protect the interest of the listed company. The Company is in compliance with said circular.

Investor grievances redressal through the SEBI Complaints Redress System (SCORES) platform

SEBI vide its circular SEBI/HO/OIAE/IGRD/CIR/P/2023/156 dated 20 September 2023 stated that a complaint lodged in SCORES platform will automatically forwarded to the concerned entity with a copy to designated body.

Entity will upload Action Taken Report (ATR) on SCORES within 21 days from the receipt of the Complaint. Failure which, the designated body will take cognizance of the complaint for first review of the resolution through SCORES and ask Company to submit ATR to the designated body. The complainant may seek a second review by SEBI of the Complaint within 15 calendar days from the date of the submission of the ATR by the Designated Body.

SEBI vide its press release PR No.06/2024 dated 01 April 2024, launched the new version of the SEBI Complaint Redress System (SCORES 2.0). The new version of SCORES strengthens the investor complaint redress mechanism in the securities market by making the process more efficient through auto-routing, auto-escalation, monitoring by the ‘Designated Bodies’ and reduction of timelines.

Investors can lodge complaints only through new version of SCORES i.e. https://scores.sebi.gov.in from 01 April 2024. In the old SCORES i.e. https://scores.gov.in investors would not be able to lodge any new complaint. However, investors can check the status of their complaints already lodged in old SCORES and pending in the old SCORES. Further, the disposed of complaints filed in the old SCORES can be viewed at SCORES 2.0.

Online Resolution of Disputes (ODR)

SEBI has introduced a common Online Dispute Resolution Portal (‘ODRP’) which harnesses online conciliation and online arbitration.

In case a member is not satisfied with the resolution provided by the company/RTA, then the online dispute resolution process can be initiated through the ODR portal.

SEBI vide its circular SEBI/HO/OIAE/OIAE_IAD-1/P/CIR/2023/131 dated 31 May 2023, mandated the listed entity to enroll on the ODR portal and advised to display a link to the ODR Portal on the home page of the website. Accordingly, the company has created its profile in SMART ODR portal and uploaded the circular on company’s website for the information of the shareholders. The said profile and circular can be access using the link https://www.bajajauto.com/investors/online-dispute-resolution

Further, SEBI vide its Circular SEBI/HO/MIRSD/MIRSD-PoD-1/P/CIR/2023/72 dated 08 June 2023, advised RTA to create an online mechanism where investors can Register, Login via OTP and raise complaints or service requests. Hence, members are hereby notified that our RTA launched an online application that can be accessed at https://ris.kfintech.com/default.aspx#

Members are requested to register/signup, using the Name, PAN, Mobile and email ID. Post registration, user can login via OTP and execute activities like, raising Service Request, Query, Complaints, check for status, KYC details, Dividend, Interest, Redemptions, e-Meeting and e-Voting details.

Quick link to access the signup page: https://kprism.kfintech.com/signup

Outstanding convertible instruments/ADRs/GDRs/warrants

The Company does not have any outstanding convertible instruments/ADRs/GDRs/warrants as on date of this report.

Investor Support Centre

Members may utilise the facility extended by the Registrar and Share Transfer Agent for raising queries pertaining to dividend, KYC updation, interest/redemption, etc. by visiting https://ris.kfintech.com/clientservices/isc/

KPRISM: a mobile service application by KFIN

Members may note that our registrar and share transfer agent, KFin, has launched a mobile app KPRISM and a website https://kprism.kfintech.com/ for our investors. Members can download the mobile app and see their portfolios serviced by KFin; check their dividend status; request for annual reports; register change of address; register change in the bank account or update the bank mandate; and download the standard forms. This android mobile application can be downloaded from the Google Play Store.

Address for correspondence

Investors and shareholders can correspond with the share transfer agent or the registered office of the Company at the following address:

Share transfer agent

KFin Technologies Ltd.

(previously known as KFin Technologies Pvt. Ltd.)

Unit: Bajaj Auto Ltd.

Selenium Tower B, Plot No. 31and 32,

Financial District, Nanakramguda,

Serilingampally Mandal,

Hyderabad 500 032, Telangana

Contact persons

Bhaskar Roy

Mohd. Mohsinuddin

Tel. No: (040) 6716 2222

Fax No: (040) 2300 1153

Toll free No: 1-800-309-4001

WhatsApp Number: (91) 910 009 4099

Email: einward.ris@kfintech.com

Website: https://www.kfintech.com/ or https://ris.kfintech.com/

Company

Bajaj Auto Ltd.

Mumbai-Pune Road,

Akurdi, Pune 411 035

Company Secretary and Compliance Officer

Rajiv Gandhi

Tel. No: (020) 6610 4486

Fax No: (020) 2740 7380

Email: investors@bajajauto.co.in

Website: www.bajajauto.com

Shareholders may get in touch with the company secretary for further assistance.

Certificate by Practising Company Secretary

[Pursuant to Schedule V read with Regulation 34(3) of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 (as amended)]

In the matter of Bajaj Auto Ltd. (CIN: L65993PN2007PLC130076) having its registered office at Mumbai-Pune Road, Akurdi, Pune – 411035.

On the basis of examination of the books, minute books, forms and returns filed and other

records maintained by the Company and declarations made by the directors and explanations given by the Company.

I certify that the following persons are Directors of the Company (during 01/04/2023 to 31/03/2024) and none of them have been debarred or disqualified from being appointed or continuing as directors of the Company by the Securities and Exchange Board of India/Ministry of Corporate Affairs or any such statutory authority.

|

Sr. |

Name of Director |

DIN |

Designation |

|||

|

1 |

Nirajkumar Ramkrishnaji Bajaj |

00028261 |

Non -Executive Chairman |

|||

|

2 |

Madhurkumar Ramkrishnaji Bajaj (1) |

00014593 |

Non -Executive Vice Chairman |

|||

|

3 |

Rajivnayan Rahulkumar Bajaj |

00018262 |

Managing Director & CEO |

|||

|

4 |

Sanjivnayan Rahulkumar Bajaj |

00014615 |

Non -Executive Director |

|||

|

5 |

Pradeep Shrivastava |

07464437 |

Whole-time Director |

|||

|

6 |

Rakesh Sharma |

08262670 |

Whole-time Director |

|||

|

7 |

Balaji Rao Jagannathrao Doveton (2) |

00025254 |

Independent Director |

|||

|

8 |

Dr Naushad Darius Forbes |

00630825 |

Independent Director |

|||

|

9 |

Anami Narayan Prema Roy |

01361110 |

Independent Director |

|||

|

10 |

Pradip Panalal Shah |

00066242 |

Independent Director |

|||

|

11 |

Lila Firoz Poonawalla (3) |

00074392 |

Independent Director |

|||

|

12 |

Abhinav Bindra |

00929250 |

Independent Director |

Notes:

|

1. |

Madhurkumar Ramkrishnaji Bajaj resigned on 24 January 2024 and ceased to be a director of the Company w.e.f. 24 January 2024. |

|

2. |

Balaji Rao Jagannathrao Doveton expired on 28 November 2023 and ceased to be a director of the Company w.e.f. 28 November 2023. |

|

3. |

Lila Firoz Poonawalla ceased to be an Independent Director with effect from close of business hours on 31 March 2024 on completion of her term of appointment. |

|

Pune: 18 April 2024 |

Shyamprasad D Limaye |

|

UDIN: F001587F000162407 |

FCS No. 1587 CP No. 572 |