Among the major nations of the world, India will have posted the highest GDP growth for FY2024.

The second advance estimate released by the National Statistics Office (NSO) on 29 February 2024 pegged real GDP growth in FY2024 at 7.6%.

In its latest World Economic Outlook (January 2024), the IMF has placed India as the fastest growing major economy in the world for both CY2024 and CY2025.

That is not all. Consumer price inflation (CPI) has significantly moderated and the current account deficit (CAD) has also reduced.

It would seem, therefore, that the Indian economy is in a sweet spot and is by far the fastest growing major economy in the world.

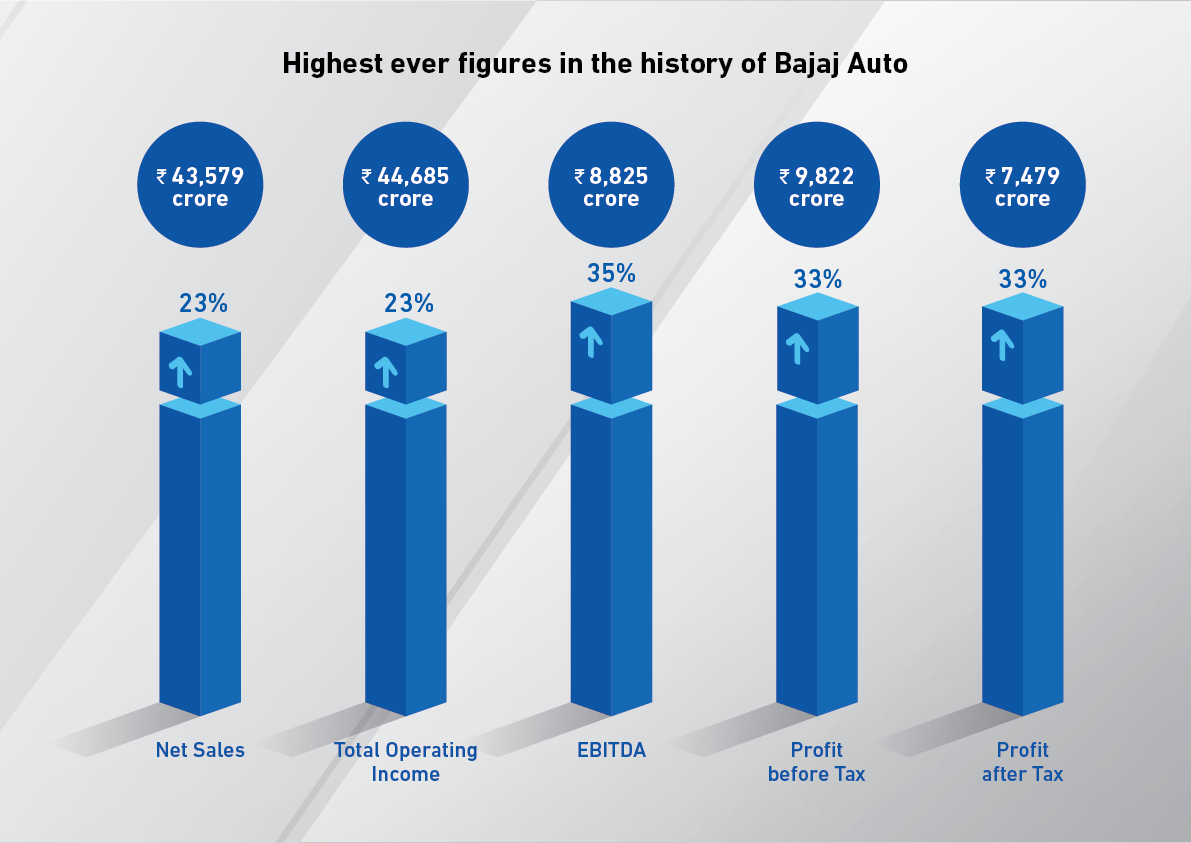

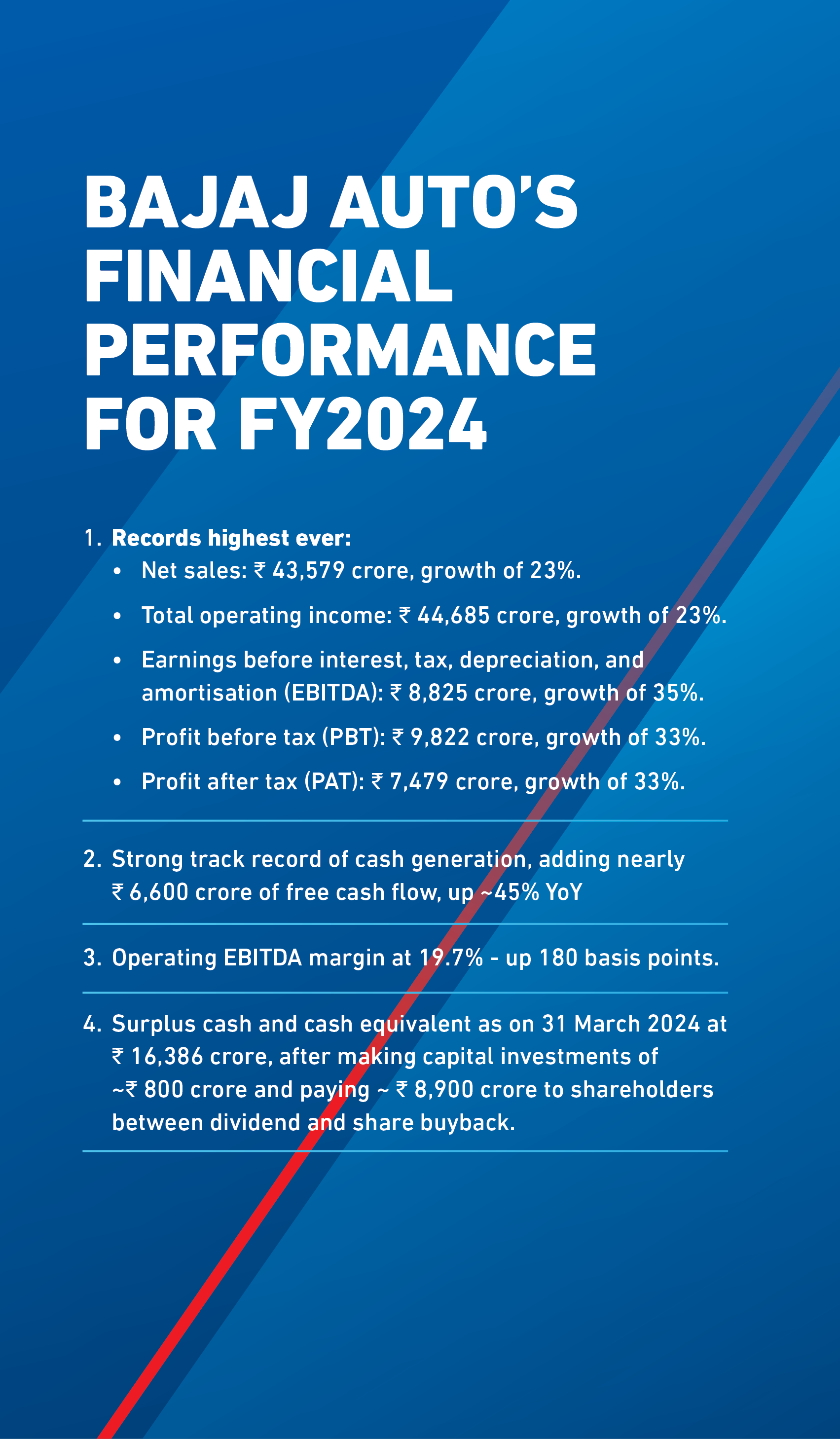

Given this encouraging macroeconomic scenario, it is not surprising that consumer sentiments have stepped up. And Bajaj Auto has performed better than ever before. Here is a snapshot.

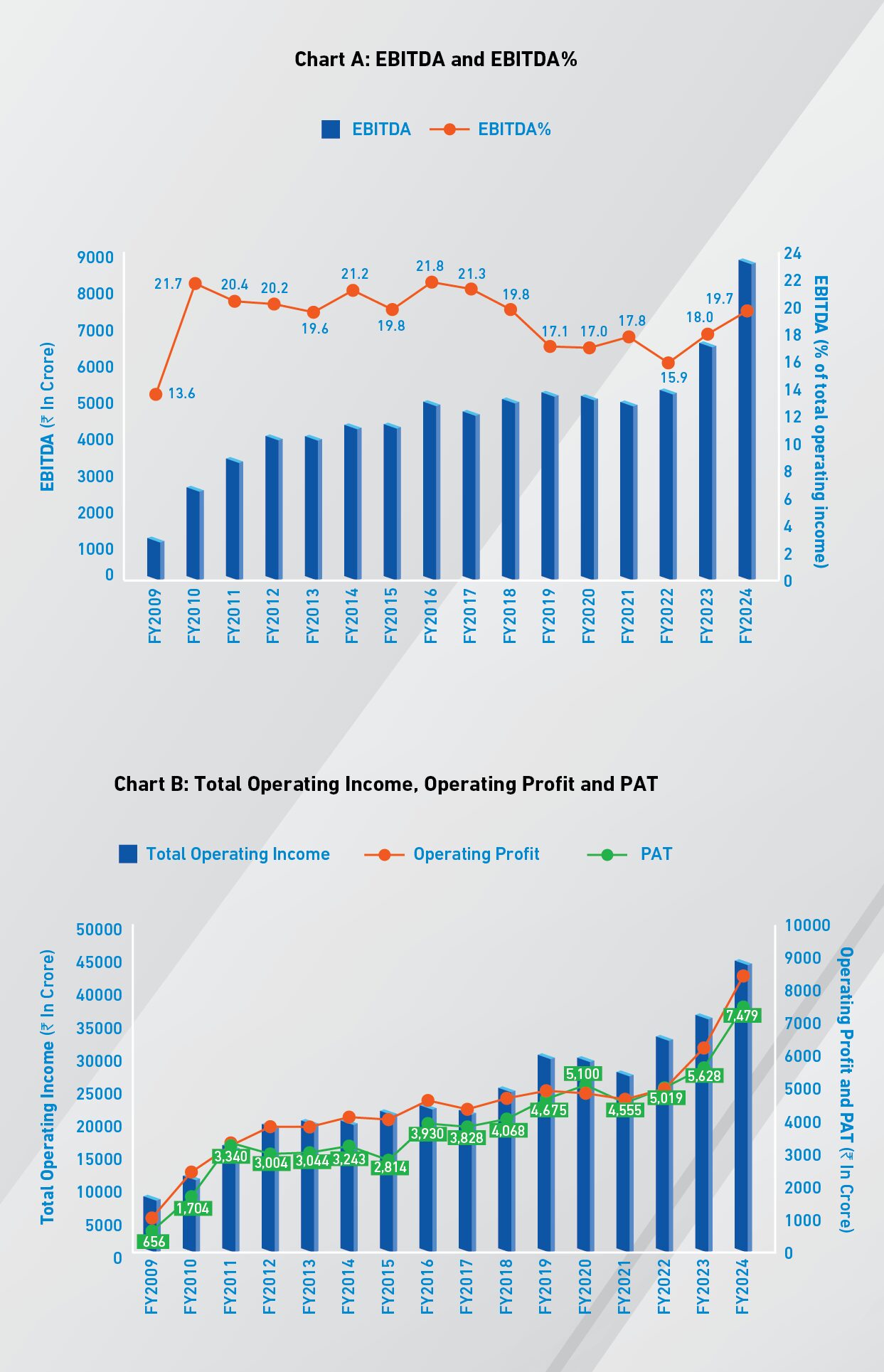

Charts A and B plot the Company’s financial performance

Coming to our business

●Domestic Business: Achieved record revenue with double-digit growth for eight consecutive quarters, driven by volume growth across all segments, including motorcycles, premium bikes, three-wheelers, and electric vehicles.

●Exports: Amidst challenging macroeconomic conditions across key overseas markets, exports stepped up in the second half of the year to end full year revenue at the same level as previous year. This was led by the Latin America and Middle East regions which partly alleviated the drop in Africa and Asia.

●Domestic Motorcycles: Maintained its strong competitive performance. In 125cc+ segment, led by Pulsar models, our growth was eight times that of the rest of the industry, making it the biggest ever year in this segment.

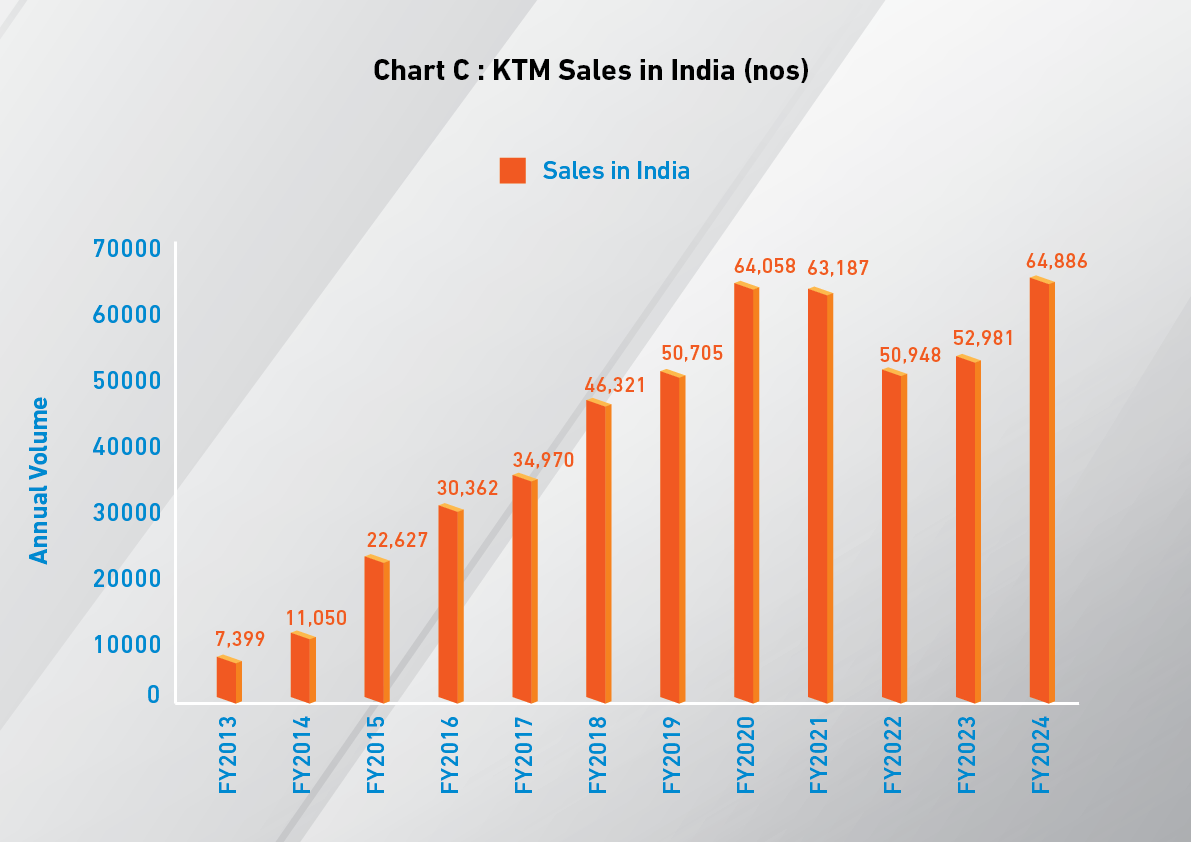

●KTM and Triumph: KTM achieved its highest sales in the year and Triumph which delivered over 40,000 units in its first eight months post launch is adding further strength to the company’s premium bike portfolio. Triumph’s expansion is well underway having been present in 56 cities domestically and 16 countries worldwide at the end of the financial year.

●Commercial Vehicles: Achieved historic high volumes, growing over 50% year-on-year. The Bajaj ‘RE’ and ‘Maxima’ products captured an 80% market share for the first time. The much awaited electric three wheelers was successfully rolled out and encouraging launch experience in the early cities prompted its acceleration of network expansion across the country.

●Chetak EV: Volumes tripled year-on-year, now #3 player in the segment. Product innovation, network expansion (present in 164 cities), and brand activation are driving this growth.

Motorcycles (domestic)

FY2024 saw a growth of 13.9% in the domestic motorcycle industry. In this industry, how did Bajaj Auto perform?

Table 1 gives the data on domestic sales.

|

Table 1: Domestic Sale of Motorcycles (in numbers) |

||||||||||

|

Year ended 31 March |

Domestic sales for the industry (nos.) |

Domestic sales growth |

BAL’s domestic sales (nos.) |

BAL’s domestic growth |

BAL's market share |

|||||

|

2022 |

8,984,186 |

(10.3%) |

1,632,897 |

(9.7% |

) |

18.2% |

||||

|

2023 |

10,230,502 |

13.9% |

1,769,575 |

8.4% |

17.3% |

|||||

|

2024 |

11,653,237 |

13.9% |

2,121,491 |

19.9% |

18.2% |

|||||

In FY2024, Bajaj Auto’s sales increased by 19.9% to over 2.1 million units – the second highest volume of domestic sales over the last decade and consequently market share increased by 90 basis points to 18.2%.

Bajaj Auto is firmly entrenched in the domestic motorcycle market with its key brand — Pulsar. In FY2024, Pulsar as a brand grew by 37% and sold over 1.4 million units. This was the highest ever sales in any financial year since inception of Pulsar

Having said so, a question arises: as vast number of Indian customers are getting more prosperous, style conscious and have ready access to consumer finance, are we seeing a fundamental shift in the domestic market for motorcycles?

The answer is a yes. To understand it, we need to go back some 15 years when there really was an overwhelming mass of basic 100cc motorcycles. It was a market about price, durability and fuel economy. Style, speed and power had not yet entered the consumers’ imagination.

100cc-110cc segment: Not surprisingly, therefore, all motorcycle manufacturers focused on the 100cc-110cc segment; and even to this day, in terms of volumes, it accounts for 49% of total domestic sales. In FY2024, this segment grew by 7%. Bajaj Auto is present here with its CT and Platina brands which averaged sales of almost 49,000 units per month and accounted for 10% share of this category.

It needs to be stated that though popular to consumers at the bottom of the riding pyramid, this segment often tend to face great pricing pressures; and have to live with small margins that come under severe pressure with rising input cost.

125cc and above segment: Bajaj Auto has chosen to concentrate on the more stylish, more modern 125cc and above segment — by far the fastest growing segment. Industry volume in this segment grew by an impressive 21% in FY2024; and it accounted for over 50% of the total volume of motorcycle sales in India. With Pulsars, Dominars, KTMs, Husqvarnas, Avengers and Triumphs, Bajaj Auto sold over 1.5 million units in FY2024 and accounted for 26% share in this category.

Bajaj Auto plays in both the segments.

●First, the basic 100cc-110cc segment. Here, the Company carefully calibrates value, balancing the price versus cost equation.

●Second, the 125cc and above segment, which is the fastest growing and caters to customers opting for stylish, powerful and brilliantly designed ‘look-me-in-the-face’ bikes. This gives both profits and volumes.

Probiking

KTM and Husqvarna motorcycles form the core of Bajaj Auto’s Probiking business. In FY2024, KTM delivered its highest ever retail sales and billing since its inception (see Chart C). KTM motorcycles are available across the country in 125cc, 200cc, 250cc and 390cc categories.

KTM upgraded its world-famous Duke range with the third generation Duke 390cc and the Duke 250cc. These completely new bikes offer sharper handling, superior performance, segment first electronically driven technological features like traction control, cornering ABS and multiple ride modes. KTM also strengthened its Adventure range with the launch of the special Rally edition Adventure 390 with adjustable suspension and spoke wheels. The Husqvarna range was also upgraded with a brand-new generation of the Svartpilen 401 and the Vitpilen 401.

The business is driven on the back of world-class high-performance products, experimental rides along with community management and customer experience. The rides and community program started three years ago and goes under the Pro-XP – Experiences That Make You A Pro. The program runs tours, academies, rides and overnighters for KTM customers. This year more than 20,000 customers participated in these unique experiences. The KTM brand has been driving customer experience through high Net Promoter Score (NPS). Last year, it delivered an industry high 90% NPS.

Triumph

The Triumph is a truly iconic 120 year-old British brand. Who can forget Steve McQueen, Paul Newman, Marlon Brando, Warren Beatty, Elvis Presley or Peter O’Toole riding theirs Triumphs?

After years of joint development, Bajaj Auto launched two Triumph models: the Speed400 and the Scrambler400X, which are being produced in our new Chakan 2 plant. As a modern classic, Triumph plays in the large bike segment and fills the gap of technology-led, high-performance motorcycles designed in their timeless forms. These two bikes were globally revealed in London in June 2023; which was followed by the first launch in India in July 2023. Both models generated unprecedented excitement and sold over 40,000 units in about nine months from launch.

Bajaj Auto also took over the existing distribution network of Triumph in India of 15 showrooms. In nine months since the launch, this network has been expanded to 78 showrooms across 56 cities.

Urbanite (Chetak EV)

Chetak EV demonstrates the future of mobility – offers a digitised, fully-connected riding experience by virtue of being embedded with mobility solutions like data communication, security and user authentication.

Introduced in 2020, the Company sold 8,187 units in FY2022, 36,260 in FY2023 and 115,702 in FY2024. Bajaj Auto introduced a second model, the Chetak Urbane, in November 2023 and upgraded the Chetak Premium in December 2023. Currently, these two models, are offered through a network of 204 dealers in over 160 cities and is at #3 position, from #7 last year. This was achieved on the back of significant efforts behind building supply chain capabilities, investments in R&D and growing retail presence offering superior customer experience. Table 2 gives the data.

|

Table 2: Domestic Sale of Chetak EV (in numbers) |

||||

|

Year ended 31 March |

Nos. |

Growth |

||

|

2022 |

8,187 |

487% |

||

|

2023 |

36,260 |

343% |

||

|

2024 |

115,702 |

219% |

||

Three-Wheelers (Domestic)

FY2024 has seen the highest ever volume of domestic sales for both the internal combustion engine (ICE) variants and the relatively more recent electric three wheelers. Total domestic sales for ICE and electric three-wheelers surpassed 681,000 units in FY2024. Increasing CNG pump network, attractive retail finance offerings, better earnings for the drivers and pent-up demand were the key drivers of growth. The quantitative performance is highlighted in Table 3.

|

Table 3: Domestic Sale of Three-Wheelers (in numbers) |

||||||||||||

|

Particulars |

ICE three-wheelers |

EV three-wheelers |

||||||||||

|

FY2024 |

FY2023 |

FY2022 |

FY2024 |

FY2023 |

FY2022 |

|||||||

|

Passenger carriers |

|

|

|

|

|

|

||||||

|

Industry sales |

483,955 |

329,784 |

166,147 |

69,887 |

15,628 |

4,923 |

||||||

|

Bajaj Auto sales |

400,846 |

261,386 |

130,172 |

10,761 |

0 |

0 |

||||||

|

Bajaj Auto market share |

82.8% |

79.3% |

78.3% |

15.4% |

0.0% |

0.0% |

||||||

|

Goods carriers |

|

|

|

|

|

|

||||||

|

Industry sales |

95,276 |

81,309 |

67,900 |

32,044 |

17,018 |

6,764 |

||||||

|

Bajaj Auto sales |

50,336 |

38,623 |

30,427 |

1,470 |

0 |

0 |

||||||

|

Bajaj Auto market share |

52.8% |

47.5% |

44.8% |

4.6% |

0.0% |

0.0% |

||||||

|

Total three-wheelers |

|

|

|

|

|

|

||||||

|

Industry sales |

579,231 |

411,093 |

234,047 |

101,931 |

32,646 |

11,687 |

||||||

|

Bajaj Auto sales |

451,182 |

300,009 |

160,599 |

12,231 |

0 |

0 |

||||||

|

Bajaj Auto market share |

77.9% |

73.0% |

68.6% |

12.0% |

0.0% |

0.0% |

||||||

Regarding the ICE three-wheelers:

●The Company continued to enjoy by far the dominant market share in ICE three-wheelers. In FY2024, market share increased by an impressive 490 basis points to 77.9%.

●Bajaj Auto’s competitive position strengthened in both passenger and cargo segments. In FY2024, sales increased by 50% to 451,182 units.

●Bajaj Auto’s passenger vehicle sales grew by 53% with a volume of 400,846; and that of cargo grew by 30% to 50,336 units.

A very interesting and potentially revolutionary move in FY2024 has been Bajaj Auto introducing electric three-wheelers in both the passenger and goods carrier segments. The gaining popularity and the segment leadership in the early launch cities is very encouraging, leading to advancement of rollout plans. The electric three-wheelers are currently sold across 60 cities. We expect considerable demand in this category.

Exports

FY2024 has been a difficult year for exports – largely due to geopolitical uncertainties and economic challenges like hyper-inflation and scarcity in dollars availability in our key export geographies.

In FY2024

●We sold 1.64 million units versus 1.82 million vehicles in the previous year.

●LATAM region recorded highest ever motorcycle sales.

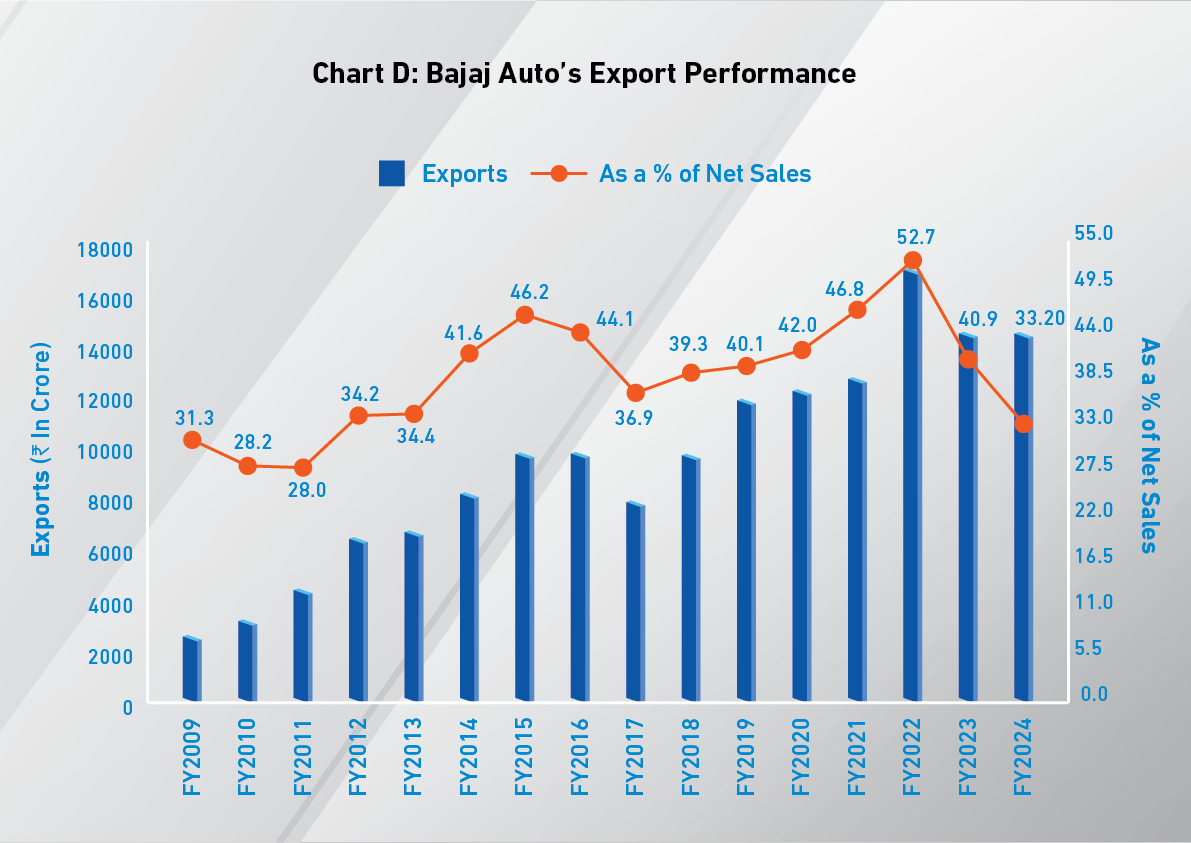

Table 4 and Chart D track Bajaj Auto’s export performance.

|

Table 4: Export Volume and Value, for Bajaj Auto |

||||||

|

Particulars |

FY2024 |

FY2023 |

Change |

|||

|

Units |

||||||

|

Motorcycles |

1,477,338 |

1,636,956 |

(9.8%) |

|||

|

Commercial Vehicles |

158,872 |

184,284 |

(13.8%) |

|||

|

Total numbers |

1,636,210 |

1,821,240 |

(10.2%) |

|||

|

Exports in ₹ (crore) |

14,449 |

14,458 |

(0.1%) |

|||

|

Exports in USD (million) |

1,705 |

1,787 |

(4.6%) |

|||

Motorcycle exports:

●Bajaj Auto maintained No.1 position in the top 9 out of 12 countries that it exports to.

●Latin America (LATAM) and Middle East-North Africa (MENA) registered significant growth: 17% in the former and 29% in the latter.

●Export of Pulsars has grown by 26%. Sports brands that enjoyed good growth were the Pulsar NS125, N160, NS160, NS200, N250, the RS200 and the Dominar 250.

●The jointly developed Triumph Speed400 and Scrambler400X motorcycles are currently being seeded across 16 countries.

●Within LATAM, Argentina, Mexico, Peru, Guatemala have shown volume growth. Similarly, within MENA, exports to Ethiopia, Turkey and Saudi Arabia have grown considerably.

●Bajaj Auto continues to retain leadership in Nigeria despite economic and currency headwinds; and grow market share in Colombia, Mexico, Argentina, Guatemala, Turkey, Ethiopia.

Commercial vehicles exports:

●Leadership position was maintained in Top 11 out of 12 countries.

●Qute exports increased by 83% versus FY2023 largely due to growth in LATAM.

●LATAM and East and South Africa have registered significant growth in FY2024: 38% in the former and 50% in the latter.

●Bangladesh, Myanmar, Afghanistan, Peru, Mexico and Guatemala have shown growth in both volumes and market share.

R&D

During FY2024, Bajaj Auto’s R&D strengthened its thrust on the premium and sports category of motorcycles as well as in EV portfolio of two and three-wheelers. Introduction of new products and upgrades is reflected in strong performance of the Company.

ICE Products

N250 and F250 upgrade

The Pulsar N250 and F250 is upgraded for an enhanced user experience with fully digital reverse LCD monochrome instrument cluster with bluetooth connectivity and turn-by-turn (TBT) navigation. A new Bajaj Ride Connect App has been developed to support the connectivity features. Technology upgrades like traction control system with three selectable ABS ride modes, viz. Road, Rain and Off-Road, offer enhanced rider safety under varying conditions. In addition, N250 is with an upside-down Front Fork and wider front and rear tyres for enhanced vehicle ride and handling.

N160 upgrade and N160 Premium

The N160 has been upgraded with new fully digital reverse LCD monochrome instrument cluster with bluetooth connectivity. Additionally, the N160 Premium Variant has been launched with an Upside-down Front Fork Suspension. It also has a smoother assist and slipper (A&S) clutch, TBT navigation, sleek LED indicators and three ABS ride modes. Both versions come with the supporting Bajaj Ride Connect App to allow features like call accept / reject, message alerts etc.

N150 Single Disc and Twin Disc

The N150 Single and Twin Disc are designed with an all-new aerodynamic front facia with sculptural purity and a dynamic interplay of metalized dual colours. These bikes have brilliant class D Bi-functional LED projector head lamps, fully digital reverse LCD monochrome instrument cluster with bluetooth connectivity, supported by the Bajaj Ride Connect App. With a more upright stance in single disc variant and a sportier stance in the twin disc, the new Pulsar N150 is designed to provide more comfort and thrill. Both models have been received well in the market.

NS125, 160 and 200 Upgrade

NS125, 160 and 200, our muscular streetfighters, have been upgraded with a fully digital reverse LCD monochrome instrument cluster. The Bajaj Ride Connect App seamlessly connects the bike to the rider. The bikes now has an all-new aggressive LED headlamp in character with the streetfighter positioning. A USB socket charger has been added for rider convenience. The NS160UG and NS200UG headlamps have integrated LED daytime running lights (DRLs), LED blinkers and instrument cluster with TBT navigation. The all-new LED headlamp set up with LED blinkers on the NS160 and the NS200 offers best in class lighting performance and elevate an already stunning look.

Classic Pulsars Upgrade

The entire classic Pulsar lineup of Pulsar 125cc, 150cc and 220cc have been upgraded with the new fully digital reverse LCD monochrome instrument cluster, bluetooth connectivity and USB socket charger. The Pulsar 220cc also get s TBT Navigation. It is also equipped with the new LH Control switch with ‘M’ button for accepting/rejecting calls, selection and switching of modes. In all these models, the Bajaj Ride Connect App allows the rider to seamlessly interact with the bike.

Triumph Speed 400

Bajaj Auto and Triumph have worked closely together to create two world class bikes: the Speed 400 and the Scrambler 400X. The Speed 400 has set the benchmark for a modern classic roadster. With Triumph’s iconic styling and attention to detail, it sets the tone in its class with performance, drive and linear power delivery. 80% of the maximum engine torque is available from 2,500 rpm to 7,500 rpm, which makes it extremely tractable and effortless. The refinement levels are outstanding compared to benchmark world competition. The Speed 400 brings the classic Triumph style, agile handling, responsive performance, and a category-defining quality to a new class of riders.

Triumph Scrambler 400 X

The purposive design DNA of Triumph’s successful Scrambler 900 and Scrambler 1200 family has been brought into the 400cc class. This timeless classic design has evolved beautifully with modern touches. Packed with confidence inspiring chassis and a rugged off-road attitude with extra suspension travels, this motorcycle brings the authentic ‘Scrambler’ experience to a long distance travel. A comprehensive OE accessory system has been developed to cater to the needs of the rider.

KTM Duke 390 / 250 Gen3

The Gen3 Duke 390 with an all new engine and vehicle platform has been introduced. Highlights are: offset mono shox mated to a cast aluminium banana swing arm, cast aluminium rear sub-frame, cornering ABS with motorcycle traction control, bonded glass TFT speedometer with connected features including TBT navigation, hazard lights and a bigger 15 litre fuel tank. Handling and power delivery, the hallmark of Duke, have been further enhanced in a true Ready-to-Race spirit. The new generation engine also offers better ground clearance along with weight optimisation.

Duke 250 Gen3 comes in as a sibling to the 390, with an all-new engine optimised for cost and weight. This has made the vehicle lighter while substantially improving driveability and handling. The quick shifter feature enabled by electronic throttle, LCD instrument with connectivity features including TBT navigation and a bigger dot matrix screen adds to enhanced user interface experience.

Husqvarna Svartpilen 401 / Vitpilen 250 MY24

The all new Husqvarna Svartpilen model has been launched in India for the first time as a 400cc bike. It comes with spoked wheels and semi-knobby tires to match the character of a scrambler. The new, clean, and elegant Swedish design with its unique style and stance makes this bike stand out among the crowd. The Vitpilen 250, with its directional tyres and an appropriate ride posture as a street version, comes in refreshing white colour with alloy wheels making the bike look really cool. A large 13 litre fuel tank gives it a good range with the 250cc engine. A bigger LCD screen with an optional connectivity feature enhances the user experience.

EV Products

Chetak Premium and Urbane

The Chetak variants have been upgraded with improved aesthetics, features and performance while substantially lowering costs. The Chetak Premium now features a 5-inch TFT instrument cluster, higher capacity battery for increased range, increase in maximum speed and a higher under-seat storage volume. The Chetak Urbane features a colour LCD instrument cluster, offboard charger as well as a higher under-seat storage. TecPac unfolds many user interface enhancement features as well as functions like Ride modes, App connectivity, Sequential blinkers, Music play-pause etc.

RE EV 9.0

RE EV 9.0 is our first electric 3-wheeler in the passenger segment. It carries forward the DNA of our RE Autorickshaw platform with an efficient Li-Ion battery pack. The in-house designed electric motor and all electronic control units coupled with an innovative two-speed automated manual transmission (AMT) provide class leading efficiency. This, along with radial tyres, deliver best-in-class range, performance and acceleration.

Maxima Cargo 9.0 & 12.0

Bajaj Maxima-Cargo has been transformed into an electric cargo vehicle with two battery pack options. The product carries the ruggedness and load carrying ability of the Maxima Cargo and best-in-class performance and range that is more than sufficient for daily operations. The innovative two-speed AMT transmission developed in-house provide class leading efficiency. Both products are offered in two Load Tray sizes to cater to different market segments and can carry 750 kg payload up typically encountered gradients. Nothing comes close to this.

Operations

TPM

Bajaj Auto’s ‘back end’ consists of its manufacturing, engineering, development, and materials function. The principles and philosophy of TPM guide and align these functions to achieve excellence, enhanced productivity, world-class quality, all at low cost. ‘The TPM way’ has been successfully extended to BAL vendors, dealers, and international distributors.

Bajaj Auto’s TPM at Operations

In FY2024, the Chakan plant of Bajaj Auto Ltd was conferred with the most coveted and prestigious award for ‘World Class TPM Achievement’ by JIPM (Japan Institute of Plant Maintenance). This is ‘The First’ for any Indian origin company’s plant across the entire industry. Chakan has become the 31st plant in the world to get this prestigious award.

Bajaj Auto also received the award for ‘Global Leaders Initiative for TPM’, which is a first for any Indian Company.

Our back-end has defined various ‘focused improvement themes’. Over the years, we have established a production system that can flexibly respond to faster new product manufacturing as well as meet volatility, uncertainty, complexity and ambiguity (VUCA) in market demands. Our engineering has developed capabilities through its various verticals including automation and robotics to improve operational parameters in both production and process management. Further, to improve and excel, we work on the ‘Bajaj Production System (BPS)’ which aims at ‘Better Flow with Better Quality’, aligning our efforts at the back end to encompass the entire supply chain.

Vendor TPM Activities

Co-existence and co-prosperity of our business partners is equally important. Bajaj Auto facilitates fair trade, environmentally preferable purchasing, human resources development and efficient procurement. We actively promote and monitor good ESG practices throughout the supply chain. 5 vendor partners were honoured with JIPM awards in FY2024. The total number of vendors achieving JIPM TPM awards till date are 35. The groundwork was laid by the Bajaj TPM Excellence Award with 77 vendors achieving this till date. This reflects a strong alignment between Bajaj Auto and its vendors in embracing the principles of TPM — that is now being extended to Tier 2 Vendors. Under the Safety, Health, Governance and Environment pillar of BAL’s TPM and in alignment with the ‘Green Purchase Policy’, various activities were initiated — with majority of our vendors having been certified for ISO 14001 & OHSAS 18001. A set of 45 vendors have started using renewable energy and implemented rooftop solar equivalent that can fulfil the need for 37 MW power.

TPM in Dealer Service and Overseas Distributor Plants

TPM methodologies are being continuously practiced by our business partners in India and other global locations and the culture of kaizen is well spread across our dealers and distributors. Over 100 kaizens are implemented with active involvement of their employees.

We started TPM implementation at our international distributor plants four years ago. As of FY2024, 22 distributor plants have been practicing TPM for over a year. They are now experiencing major improvements in productivity, first-time-right quality and optimization in cost parameters. Five of our distributor plants qualified for the ‘BAL TPM Award’. As on 31 March 2024, we had 1,131 dealerships practicing TPM and 624 dealerships have been awarded the ‘BAL TPM Award’.

Capacity and Employee Strength

|

Table 5: Plant-wise capacities (in units per annum) – BAL + CTL |

|||||

|

Plant |

As on 31 March 2024 |

Product Range |

|||

|

Waluj |

Motorcycles |

2,700,000 |

Boxer, CT, Platina, Discover, Pulsar |

||

|

Commercial Vehicles |

930,000 |

Passenger Carriers, Good Carriers, Quadricycle |

|||

|

Chakan 1 |

Motorcycles |

900,000 |

Pulsar, Avenger, Dominar |

||

|

Chakan 2 |

Motorcycles |

300,000 |

KTM, Husqvarna, Triumph |

||

|

Chakan 1 / Akurdi |

Scooters |

480,000 |

Chetak, Yulu |

||

|

Pantnagar |

Motorcycles |

1,800,000 |

CT, Platina and Pulsar |

||

|

7,110,000 |

|||||

As of 31 March 2024, BAL’s employee strength stood at 8,570. This excludes Chetak Technology Limited’s employee strength of 256.

Women Employment

Our women employee strength has grown over four times: from 148 in FY2014 to 643 in FY2024. Almost 55% of the women are working in manufacturing plants and in engineering.

Human Resource (HR)

FY2024 has been significant for the HR function at Bajaj Auto. We have been able to make big strides in our HR agenda by (i) strengthening our employer brand; (ii) enabling more learning opportunities for across diverse skill-sets; and (iii) building further on engaging our talent.

Our ability to attract experienced and top-tier talent from the best of India’s campuses has seen an upward trend. Our presence in India’s premier engineering campuses — the IITs and NITs has strengthened. While engaging college talent through our flagship events of TORQ and OHM on engineering campuses, we have created another property called ‘Watt’s Up’, which is our tech talk series. Through these events, 5,000 students have been actively engaged with our employer brand. These efforts resulted in 44% of our total Graduate Trainee Engineers (GTE) 2024 offers being made to IITians. Our efforts in attracting women talent resulted in over 100 GTE offers to women engineer.

Our employer brand has seen increased engagement through our LinkedIn page. With 1.3 million followers, we have maintained our position of having the largest followership for any two and three-wheeler company worldwide.

Given our focus on growing talent from within, we launched a structured First Time Managers Program to invest in the long-term success. Also, with a multi-generational mix of our workforce, we have instituted a Multi–Generational Leadership Program to equip leaders and managers with skills to effectively lead across diverse generations.

This year, we have also rolled out capability-building initiatives to address personalized learning needs of 100% of our first line managerial talent population through iExcel and Functional Skill Mapping. We have extended our Learning & Education Assistance Program (LEAP) to include three more leading institutes: University of Warwick, IISc Bangalore, and BITS Pilani. Alongwith our existing collaborations with Loughborough University and IIT Madras, we now offer over 30 diverse programs. Through these five institutes, our talent has now access to Masters and Certification programs that offer learning in cutting edge and future skills.

Through our Development Centre (DC) process, we have reached a cumulative penetration of leadership competency-based feedback for almost 95% of our top talent. With an increasing number of women joining us every year, our flagship initiative, Up!Swing, that is exclusively offered to women, continued this year. Through Up!Swing, we focus on enabling our women talent to develop into leadership roles. We also launched a maternity handbook this year to sensitise team managers and peers towards women’s experiences before, during, and after maternity.

Our annual employee engagement survey, Pulse, was rolled out for the second time this year. Pulse achieved an impressive response rate of 96%. Our employee engagement scores rose to 88%, surpassing the score of previous year. In addition, we collaborated with a global partner, Ethisphere Institute, and launched an Ethics Survey, which was participated by some 1,500 employees. Feedback from the survey will help in enhancing our understanding and adherence to ethical values.

For three consecutive years, Bajaj Auto has been recognised as a ‘Company with Great Managers’ by an independent third-party organization. Our employees have also been recognized on multiple forums like 1000 Women’s Leaders, The Great Managers Award, HR 30under30 and HR 40under40 Future HR Leaders.

Corporate Social Responsibility (CSR)

Bajaj Auto is building competence around selected areas and help focus on large scale impact.

Skilling Initiatives

A. Bajaj Engineering Skills Training (BEST)

This initiative is in collaboration with top NIRF-ranked universities and engineering colleges to make the youth competent and employable. The objective is to establish state-of-the-art centres with laboratories having world-class equipment to enable hands-on-skilling of engineers and diploma holders. The first BEST centre was recently inaugurated at the Symbiosis Institute of Technology, for 120 students – with an aim to expand with additional 15 universities.

B. Bajaj Manufacturing Systems (BMS) Certification program

This initiative aims to impart industry knowledge to ITI and polytechnic students, through a user-friendly Learning Management System. The program partners with technical institutions to provide exposure to students across 9 modules based on TPM practices implemented at Bajaj Auto. Over 3,000 students from government and private ITI institutes were successfully certified. The program is set to expand significantly, with plans for introduction to additional 6 states.

C. Lighthouse Communities Foundation

Lighthouse Communities Foundation is a non-profit organisation working towards building inclusive communities with special focus to enhance employment opportunities through activities like vocational skilling, counselling and training to set-up mini enterprise. It has operationalised a centre at the Janta Vasahat slum in Pune and enabled over 1,000 youth.

Education programs in and around our local area

A. Scholarships for Higher Education

Bajaj Auto has initiated the ‘Rupa Rahul Bajaj Scholarship Program’ which aims at aiding students from underprivileged backgrounds to pursue higher education in esteemed universities and colleges. With a meticulous selection process to identify eligible candidates, in FY2024, scholarship/financial assistance was granted to 11 students for four years.

B. Bharatiya Yuva Shakti Trust (BYST-Youth Entrepreneurship Development Program)

The program is dedicated to assist underprivileged young entrepreneurs by providing supplementary financing and voluntary assessments, personalised guidance from mentors who are from similar industries. Bajaj Auto has pledged to mentor 1,500 young individuals through BYST, aiding them in building their enterprises and fostering sustainable growth.

C. Youth Organization for Joining Action and Knowledge (YOJAK)

YOJAK offers an easily accessible platform tailored to needs of disadvantaged students, particularly girls, empowering them with essential skills and support pivotal for pursuing careers in Science Technology Engineering Mathematics (STEM) -related fields. With a network of 12 learning centres in Pune, YOJAK delivers academic excellence through subject-specific remedial classes alongside experiential learning and social support. In FY2024, over 2,000 students from grades 8 to 12 received support.

D. Foundation of Advancing Science and Technology (FAST)

FAST is dedicated to engage and inspire the Indian civil society with the wonders of scientific exploration. With a primary focus on youth, particularly those considering or already pursuing science as a potential academic or career path, FAST endeavours to narrow the divide between science practitioners and the wider community. These initiative aims to impact over 8,000 youth in the near future. FAST has outlined four key objectives: (i) Cultivating a vibrant science culture, (ii) Amplifying awareness of science and technology, (iii) Advocating for inclusivity within the scientific community and (iv) Bridging the spectrum of science and technology.

Programs under Environment sustainability

Animal Welfare

Bajaj Auto is extending its support to Canine Care and Control, an organization dedicated to animal welfare. The efforts primarily revolve around a comprehensive program aimed at managing the population of canines. In FY2024, Bajaj Auto provided support for the Animal Birth Control (ABC) program targeting the canine population in the Pune Municipal Corporation area. Alongside the ABC initiative, these canines also receive essential vaccinations against rabies.

Financials

Table 6 gives the summarised standalone profit and loss statement of Bajaj Auto.

|

Table 6: Standalone Profit and Loss Statement |

||||||

|

(₹ In Crore) |

||||||

|

Particulars |

FY2024 |

FY2023 |

Growth% |

|||

|

Operations |

||||||

|

Sales |

43,579 |

35,359 |

23.2% |

|||

|

Other operating income |

1,106 |

1,069 |

||||

|

Total operating income |

44,685 |

36,428 |

22.7% |

|||

|

Cost of materials consumed, net of expenditures capitalised |

31,696 |

26,027 |

||||

|

70.9% |

71.4% |

|||||

|

Stores and tools |

172 |

154 |

||||

|

0.4% |

0.4% |

|||||

|

Employee cost |

1,536 |

1,443 |

||||

|

3.4% |

4.0% |

|||||

|

Factory, administrative and other expenses |

1,216 |

1,086 |

||||

|

2.7% |

3.0% |

|||||

|

Sales and after sales expenses |

1,240 |

1,167 |

||||

|

2.8% |

3.2% |

|||||

|

Total expenditure |

35,860 |

29,877 |

||||

|

Earnings before interest, tax, depreciation and amortisation (EBITDA) |

8,825 |

6,551 |

34.7% |

|||

|

EBITDA % |

19.7% |

18.0% |

||||

|

Interest |

54 |

39 |

||||

|

Depreciation & amortisation |

349 |

283 |

||||

|

Operating profit |

8,422 |

6,229 |

35.2% |

|||

|

18.8% |

17.1% |

|||||

|

Non-operating income |

1,402 |

1,181 |

||||

|

Less : Non-operating expense |

2 |

1 |

||||

|

Non-operating income, net |

1,400 |

1,180 |

||||

|

Profit before tax |

9,822 |

7,409 |

32.6% |

|||

|

Tax expense |

2,343 |

1,781 |

||||

|

Profit after tax |

7,479 |

5,628 |

32.9% |

|||

|

Surplus cash and cash equivalents as on 31 March |

16,386 |

17,445 |

||||

Surplus cash and cash equivalent as on 31 March 2024 stood at ₹ 16,386 crore, after making capital investments of ~₹ 800 crore and paying a significant ~₹ 8,900 crore to shareholders between dividend and the share buyback.

Our Surplus Funds are invested in (i) fixed income securities rated A1+ for short-term and AA+ and above for long-term (ii) mutual funds and (iii) fixed deposits with banks and non-banking finance companies.

As required for listed companies by Securities and Exchange Board of India, Table 7 gives key ratios

|

Table 7: Bajaj Auto’s Key Financial Ratios, Standalone |

||||||

|

Particulars |

FY2024 |

FY2023 |

Remarks |

|||

|

Debtors Turnover Ratio |

22.36 |

21.48 |

||||

|

Inventory Turnover Ratio |

20.52 |

19.83 |

||||

|

Current Ratio |

1.19 |

1.71 |

Increase in trade payable and short term borrowing |

|||

|

Operating Profit Margin |

18.8% |

17.1% |

||||

|

Net Profit Margin |

16.2% |

15.0% |

||||

|

Debt-Equity Ratio |

0.03 |

0.0 |

||||

|

Return on Equity |

29.7% |

21.6% |

Change because of increase in profits during the year |

|||

Subsidiaries

Bajaj Auto International Holdings BV (BAIH BV)

Bajaj Auto International Holdings BV (BAIH BV) is a 100% Netherlands based subsidiary of Bajaj Auto Limited. Through this subsidiary, Bajaj Auto has invested a total of €198.1 million (₹ 1,219 crore) and holds 49.9% stake in Pierer Bajaj AG (PBAG) and thru PBAG, Bajaj Auto is a partner in all mobility businesses that the Pierer Group engages in.

PBAG holds 73.3% stake in Pierer Mobility AG (PMAG), Europe’s leading ‘Powered Two-wheeler’ manufacturer. With its KTM, Husqvarna and GASGAS motorcycle brands, it is a leading premium motorcycle manufacturer in Europe. In the year 2023, PBAG clocked revenue in excess of €2.6 billion and a profit of €60 million.

Bajaj Do Brasil Comercio De Motocicletas Ltda

To address the highly competitive motorcycle market of Brazil, Bajaj Auto has set up a wholly owned subsidiary on 31 March 2022 with a paid up equity share capital of BRL 30 million (₹ 48 crore). After obtaining all necessary approvals, the subsidiary is currently selling the Dominar range of motorcycles. The subsidiary is also setting-up a dedicated manufacturing facility at Manaus, Brazil – first such facility outside India – and is expected to be operational by mid-2024. For 2023, clocked sales of over 4,300 units, revenue of BRL 75.3 million and net loss of BRL 3.5 million.

Bajaj Auto (Thailand) Ltd.

Bajaj Auto (Thailand) Ltd. is a wholly owned subsidiary in Thailand with paid-up share capital of Thai Baht (THB) 45 million (₹ 10 crore), set-up to expand R&D’s design centre to trend-defining markets around the globe. It has all the necessary approvals from concerned authorities, is operational and international designers are working from this new facility.

Bajaj Auto Spain S.L.U.

Bajaj Auto Spain S.L.U. is a wholly owned subsidiary in Barcelona, Spain – intent being to setup an Engineering Design Centre – with an issued and subscribed share capital of €600K (₹ 5 crore). It has all the necessary approvals from concerned authorities and has become fully operational.

Chetak Technology Ltd. (CTL)

The electric vehicle (EV) market is constantly witnessing new developments, including various incentive schemes from the government of India and various state governments. Given the high stakes, Bajaj Auto felt the need to participate in this space through a 100% subsidiary with a clear focus to develop new technologies and products. The subsidiary (formed on 4 October 2021) stands adequately funded with paid-up equity share capital of ₹ 470 crore as on 31 March 2024.

Bajaj Auto Credit Ltd. (BACL)

With over two-thirds of two-wheelers and over three-fourths of three-wheelers retailed in India being financed, this activity is the key to the automobile business. Penetration, geographic coverage and expanding financing options for the retail customers of Bajaj Auto Ltd. are keys to success in future.

A wholly-owned captive financing company was formed in FY2022. It applied to the Reserve Bank of India (RBI) for an NBFC licence. On 29 August 2023, the RBI granted the Certificate of Registration as an NBFC. BACL commenced business in Maharashtra and Goa on 1 January 2024. Subsequently, it added Kerala, Karnataka, Tamil Nadu, Andhra Pradesh, Telangana, Rajasthan and Gujarat. It plans to cover all the balance states by 31 March 2025. In the first three months of its operation, BACL financed the purchase of 35,238 two-wheelers and 13,972 three-wheelers. With a paid-up share capital of ₹ 295 crore, BACL had assets under management of ₹ 708 crore as on 31 March 2024. There is considerable upside to this business in the years to come.

Consolidation of accounts and segment reporting

|

Table 8: Segment Revenue and Segment Results |

||||

|

(₹ In Crore) |

||||

|

Segment Revenue |

FY2024 |

FY2023 |

||

|

Automotive |

44,870 |

36,665 |

||

|

Financing |

17 |

– |

||

|

Investment and others |

1,419 |

978 |

||

|

46,306 |

37,643 |

|||

|

Segment Results – Profit / (Loss) from each segment before tax |

||||

|

Automotive |

8,708 |

6,905 |

||

|

Financing |

(25) |

– |

||

|

Investment and others |

1,417 |

976 |

||

|

10,100 |

7,881 |

|||

|

Less : Interest |

60 |

39 |

||

|

Profit before tax |

10,040 |

7,842 |

||

|

Profit after tax |

7,708 |

6,060 |

||

|

Segment Capital Employed |

||||

|

Automotive |

4,956 |

7,190 |

||

|

Financing |

883 |

– |

||

|

Investment and others |

24,409 |

22,677 |

||

|

30,248 |

29,867 |

|||

Cautionary Statement

Statements in this Management Discussion and Analysis describing the Company’s objectives, projections, estimates and expectations may be ‘forward looking’ within the meaning of applicable laws and regulations. Actual results may differ from those expressed or implied. Important factors that could make a difference to the Company’s operations include global economy, political stability, stock performance on stock markets, changes in government regulations, tax regimes, economic developments and other incidental factors. Except as required by law, the Company does not undertake to update any forward-looking statements to reflect future events or circumstances. Investors are advised to exercise due care and caution while interpreting these statements.